-

Our solutions

- Our solutions

-

About us

- About us

- Partners

- Support

- Offer

Your new customers are there.

In the previous article concerning cross-border e-commerce we focused on the current state of affairs of the industry in Poland and around the world. This time we will focus on the buying habits observed in Europe – we will indicate how Europeans buy online and how the Poles compare to them.

The European economy is developing at a stable pace and forecasts show that in 2019 the GDP will exceed EUR 19 billion (1). This is good news for the entrepreneurs – the purchasing power is growing simultaneously with the expanding group of active consumers. An important part of the European economy is e-commerce worth approx. EUR 600 billion (1).

In 2018 the value of the European cross-border e-commerce market was EUR 137 billion and increased by 13% in comparison to 2017 (2).

More than two thirds of Europeans have already did shopping outside of their countries. The most important reason behind the decision to do cross-border shopping is lower price or promotion. Other factors that play a role are unavailability of the given product in the buyer’s country, desire to buy a specific brand product and conviction that products offered in other countries are better (3).

What do the Europeans buy the most in online stores?

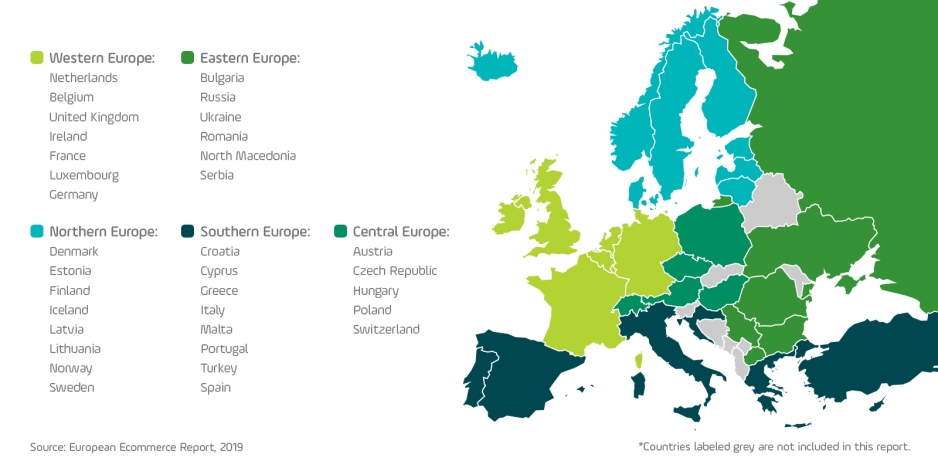

E-commerce Europe, organization supporting e-entrepreneurs in online trade, divided the European markets based on geographical location:

From the annual report published by E-commerce Europe at the beginning of June on the current state of e-commerce in Europe – among other things, its development as well as buying habits and concerns of e-consumers – we learn many interesting facts which may be a good guidepost in planning expansion of online stores to foreign markets.

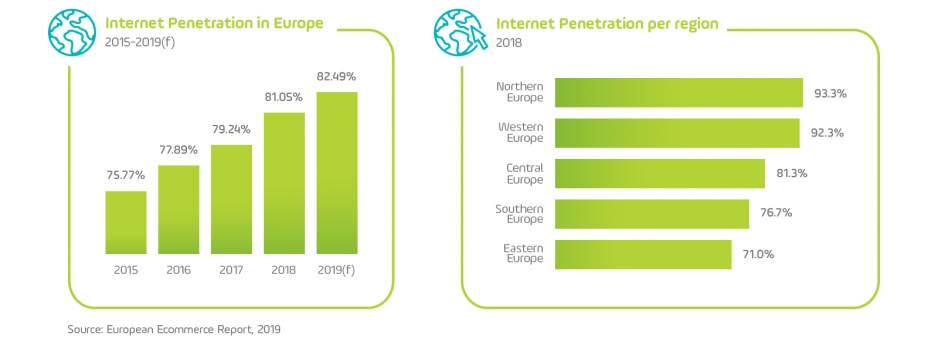

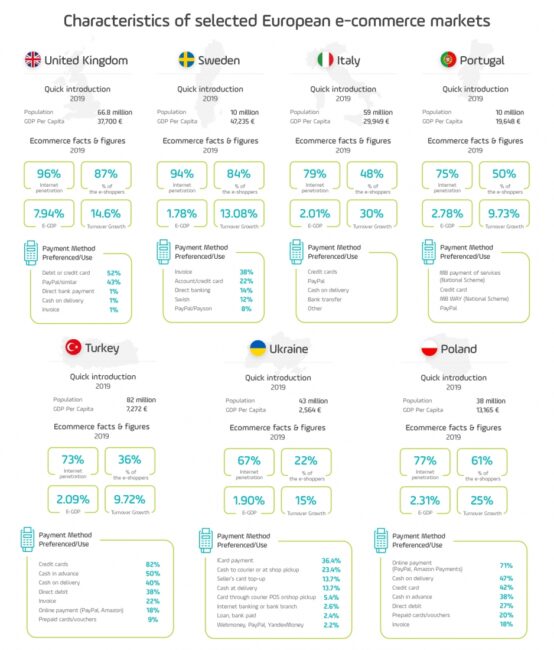

An important indicator favouring the development of e-commerce is Internet penetration on the given markets. Currently more than 80% of European households already have access to broadband Internet, which is a very good result. Northern Europe can boast of the highest number of people connected to the Internet – as many as 93.3%. The largest problems with Internet penetration can be observed in Eastern Europe – only 71% of this region’s population has access to the web.

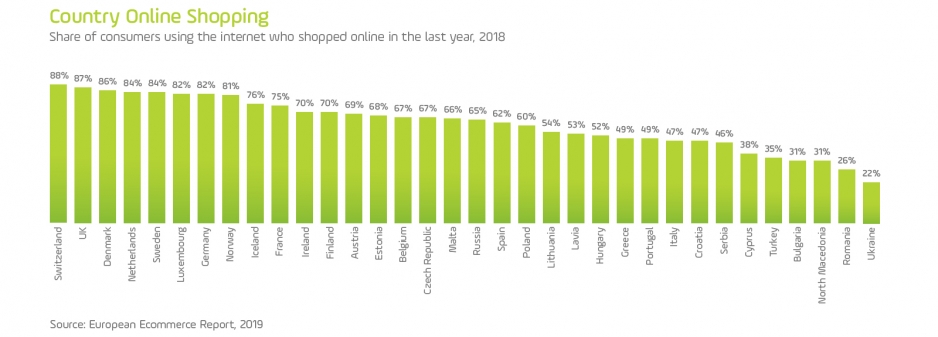

The most online shoppers can be found in Switzerland (88%), Great Britain (87%), Holland (86%) and Sweden (84%). It should also be noted that our western neighbour – Germany – also has a very high result – 82%. On the other side of the rank we have Ukraine (22%), Romania (26%), Macedonia (31%) and Bulgaria (31%). Poland scores in the middle with 60% and is successively improving its result from year to year.

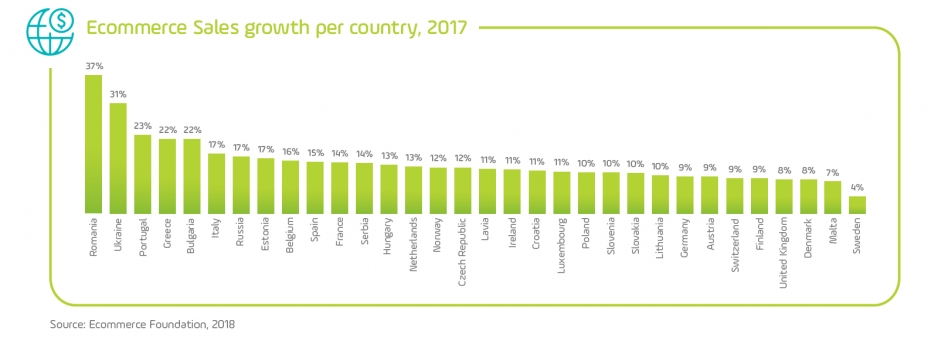

As regards the fastest growing e-commerce markets in Europe, Romania, Ukraine and Portugal are leading the way (1).

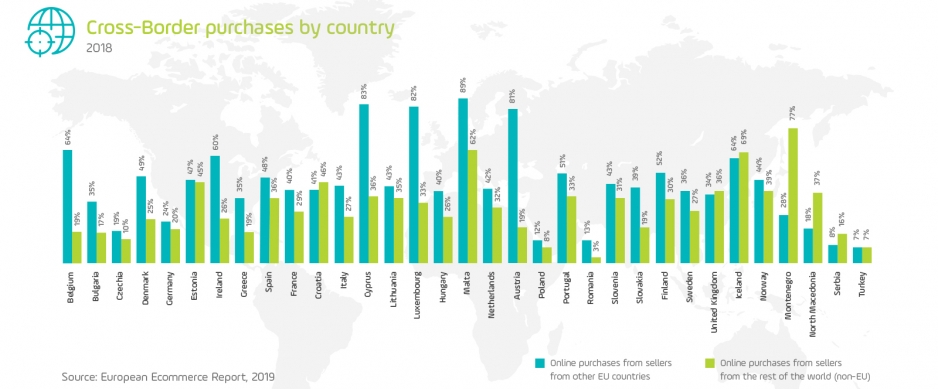

We mentioned earlier that it is e-consumers in smaller countries who are most inclined to do online shopping abroad. The citizens of Malta, Cyprus, Luxembourg, Austria, Iceland, Herzegovina, Belgium or Ireland can be listed here. Meanwhile, from among countries located closest to Poland, 24% of Germans, 19% of Czechs, 40% of Hungarians and 39% of Slovaks buy from sellers from the European Union.

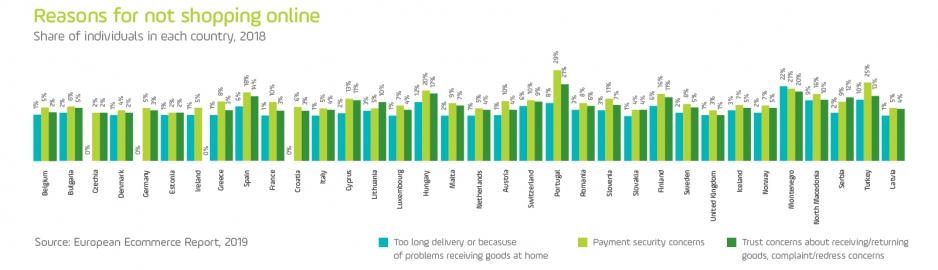

The report prepared by E-commerce Europe also takes a look at three most important barriers which consumers indicate in the context of shopping at foreign online stores:

The largest concerns associated with payments were observed among buyers from Portugal (29%), Turkey (25%), Hungary (20%) and Spain (18%), whereas the smallest concerns were observed in the Czech Republic (2%), Estonia (2%), Great Britain (3%), Slovakia (4%) and Holland.

Portuguese have the largest concerns regarding pursuing their consumer rights (21%), followed by buyers from Herzegovina (20%), Hungary (17%) and Spain (14%).

As regards the issues associated with shipping, the average percentage of consumers who are concerned about it is definitely lower, except for Herzegovina (22%), Hungary, (12%) and Turkey (10%). This same result is below the 10% mark in all other countries.

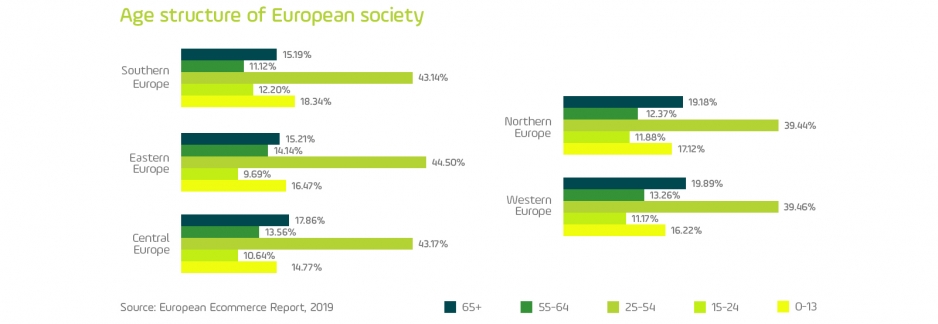

When planning foreign expansion you should focus on customers whom you want to reach. In this context it is a good idea to remember that societies in Europe are ageing, especially in Northern and Western Europe. And although elderly people predominate among the buyers, nearly one-third of people buying online are the Millennials – a very characteristic generation of consumers aged 18-34. This is an important factor which you should take into account when analyzing target groups and planning e-marketing strategies.

The data presented above show a distribution of online buyers in the USA, although this distribution is similar to that in Europe – in both cases e-consumers are aged between 18 and 55.

European countries differ when it comes to the preferred by online consumers payment methods, available delivery options, most favourite brands or even easiness of conducting e-business. In this article we focus on the most interesting markets from the perspective of the data obtained. In subsequent posts from this series we will describe in more detail the most important foreign expansion paths for the Polish e-entrepreneurs – Germany, Czech Republic and Slovakia, as well as Romania and Hungary.

All well-known marketplaces about which we wrote in one of the articles on our blog, i.e. Amazon, eBay, Etsy and AliExpress, have a huge impact on the European e-commerce market. They are a perfect solution for small and medium enterprises which might not have sufficient funds to translate their online store and adapt it to the local market or which seek other locations where they may sell their products.

Marketplaces help in reaching the target consumers in the big world of international e-commerce. Thanks to them you are able to:

Marketplaces like Amazon and AliExpress are becoming more and more popular and – although they have similar objectives: achieving growth on global markets, even faster payments and penetration of new markets – their strategies differ (4):

Amazon decided to increase their revenues and global recognition by buying and taking over subsequent enterprises. It takes over 5 times more of them than Alibaba.

Alibaba, in contrast to Amazon, invests in minority shares in companies around the world. By doing so it creates a global online shopping market, merging logistical companies and other subsidiaries.

Amazon, eBay and AliExpress play a huge role in European cross-border commerce, however, ever more stores, mostly chain stores, are close behind.

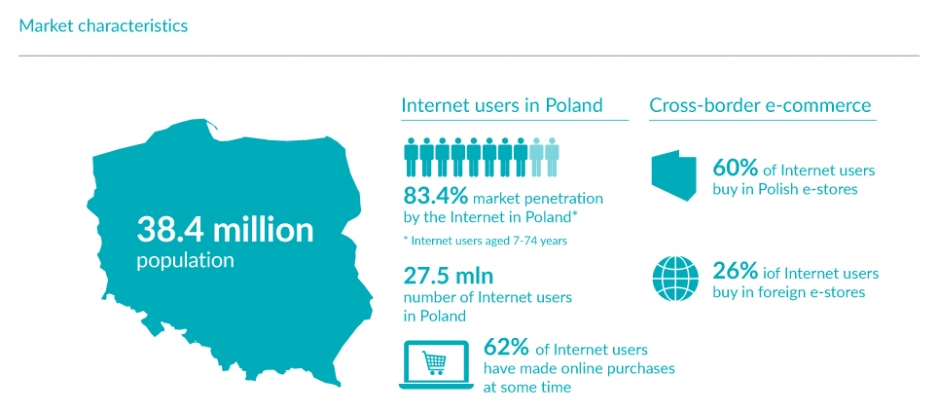

In comparison to other European countries Poland still has a bit to catch up in cross-border e-commerce. 26% of Internet users in Poland shopped in a foreign online store (6). Young people (aged between 15 and 24), people with higher education and those declaring a household income in excess of PLN 5,000.00 and inhabitants of large cities account for most of the consumers (6).

Thanks to low prices China is the most attractive market for Polish e-consumers – more than 18% buy products abroad from them. Other countries from which Poles buy are Germany (14%) and Great Britain (10%). At the same time Polish Internet users (3).

The most popular players on the Polish e-commerce market are Allegro, Empik.com, Euro.com, Mediaexpert and Zalando. Where foreign services are concerned, AliExpress held the first place. This service was spontaneously indicated by 42% of respondents who shopped in foreign online stores during the last 6 months (3).

Among the most popular products purchased by Poles declaring doing shopping in foreign online services are:

European enterprises often come across barriers which hinder them from growing. One of them is lack of equal opportunities for development on the global market. For that reason, to support cross-border e-commerce and to develop the e-commerce sector, the European Commission is working on a project of a Digital Single Market. Its aim is to modernize and harmonize the EU’s economies based on new technologies – which incorporates online shopping. Unified regulations equalizing the chances for e-commerce operators in the whole Europe and helping meet the challenges associated with technological development, for instance, GDPR, ban on geo-blocking in online trade, regulations concerning copyrights, are being implemented as part of the Digital Single Market strategy.

One of the important issues being dealt with by the Digital Single Market are cheaper deliveries of goods. Cross-border shipments may cost from 3 to 5 times more than domestic shipments.

62% of entrepreneurs who want to sell online believe that a significant barrier are high shipping charges.

For small and medium enterprises the companies’ entry on a foreign market itself may pose problems. According to EU’s data the average cost of entry onto the markets of each of the 28 member states is EUR 9,000.005. The reason for this are differences in the laws of the different countries and adaptation to the legislation of the given country. The aim of the Digital Single Market is to reduce the entry costs and to equalize the chances for all e-commerce owners in foreign expansion. This is an important breakthrough in the development of cross-border e-commerce.

As European Union’s reports and activities show, confining oneself only to one market might, in the long run, not be a good strategy for those planning to expand their e-business. Especially that the potential of cross-border trade is unlimited. Maybe new customers are waiting for your products in other European countries or somewhere else in the world?