-

Our solutions

- Our solutions

- For business

-

About us

- About us

- Offer

- Partners

- Support

How to prepare an online store for that?

Organizing logistics for online stores selling goods to customers from abroad requires special attention. This is because the time and cost of delivery are important factors that impact purchase decisions made by consumers, which we highlighted already in an article titled Cross-border sales in e-commerce – why is it worth selling products to other countries?

Currently, online stores that sell their products abroad usually incur very high costs of merchandise shipment – depending on the country, they can be several times higher than the costs of domestic delivery. This means that lower prices of sold products are often insufficient to compensate for the cost of delivery, which effectively discourages buyers from abroad. So, how should an online store be prepared for cross-border sales in terms of handling logistic processes? You will find an answer in this article.

Logistics cause many difficulties for entrepreneurs who sell goods and services abroad on the Internet. 765 e-sellers who responded to a survey conducted by Statista that concerned logistics challenges in cross-border commerce mentioned in particular the following aspects:

Issues related to logistics are also ones of most important worries of e-consumers, both those who buy from abroad and those who have not made any cross-border purchase yet.

According to the “Cross Border E-Commerce Global Consumer Report”, 46% of all respondents who have not purchased anything from a foreign online store specified high shipping cost as the greatest barrier to cross-border shopping. The respondents mentioned also long time of waiting for product delivery (38%), high taxes and customs duties (28%) and unclear final amounts of taxes and customs duties (20%) (2).

High shipping costs and long waiting times worried also respondents who made purchases at foreign online stores (54% and 50%, respectively). The consumers who made cross-border purchases stated also that high taxes and customs duties (36%), as well as exchange rates (28%) made purchasing greater quantities of products from abroad costly (2).

As many as 25% of the surveyed e-consumers who make cross-border purchases stated that the delivery times were too long for them. Other, less frequent problems were lack of possibility to specify the delivery time (10% of respondents), excessive shipping costs (9%) and problems with parcel tracking (8%).

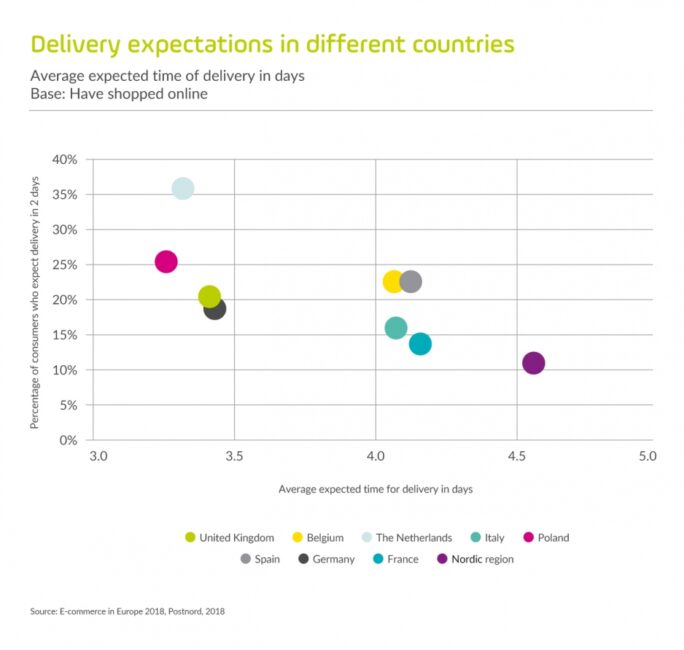

European e-consumers are very demanding as far as quick and convenient deliveries are concerned. In their opinion, a reasonable time of waiting for a consignment is from three to five days from the order placement date. Polish customers expect to receive the product as soon as possible, whereas buyers from Nordic countries are a little bit more patient. What is the cause of this difference? The expectations of Nordic buyers may arise from a higher percentage of consumers who decide to purchase abroad, or from a lower population density and from being accustomed to the fact that they must wait longer than their European neighbors even for domestic consignments (3).

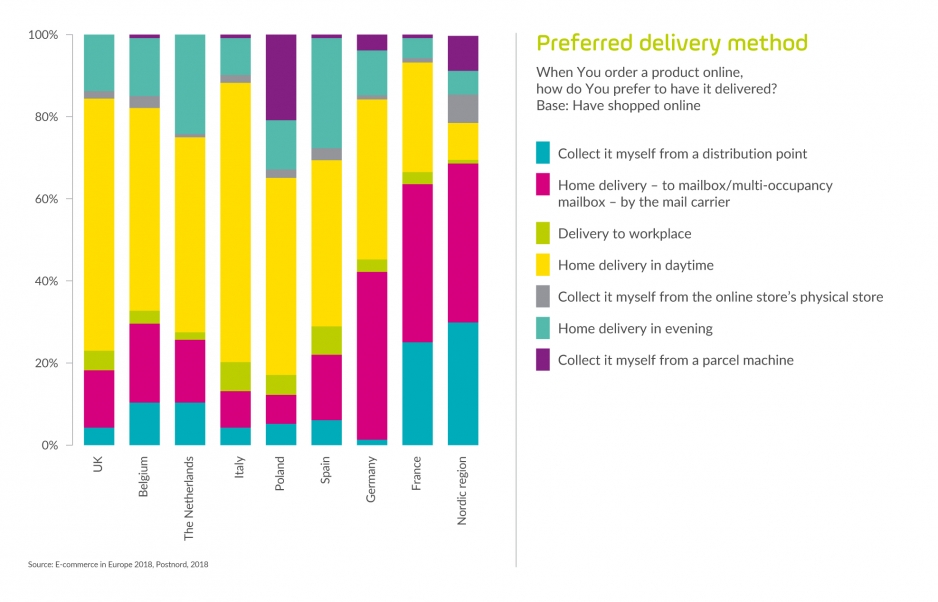

Before choosing a logistic operator for handling foreign orders, it is worth taking a look at local preferences of buyers concerning the most convenient, in their opinion, methods of merchandise delivery, and then checking to what extent the offering from a potential logistic partner matches such expectations.

Depending on the country, e-consumers show different preferences regarding delivery methods. Home delivery is generally the most attractive option, but also here preferences differ from one place to another. Two thirds of Italian consumers prefer this method compared to less than one tenth of consumers in the Nordic countries. Germans prefer direct deliveries to mail boxes, whereas Poles have become more accustomed to parcel machines than other Europeans (3).

According to a survey of 33,500 respondents from 41 countries all over the world, conducted by International Post Corporation in 2018, a majority (84%) of cross-border parcels weighed less than 2 kg, of which 9% weighed less than 100 g. 40% of cross-border parcels were worth less than EUR 25 (4).

According to the respondents, a very large percentage of cross-border shipments, namely as many as 62%, were sent for free. However, it is worth noting the reasons for free deliveries – in 38% of all cases it was the seller who offered such an option (4).

An interesting case in the context of free delivery is the Etsy.com platform, which at the end of July 2019 started promoting free deliveries in the USA for products worth more than 35 dollars. It also presented statistics showing that e-consumers were by 20% more willing to purchase an article if it would be shipped for free.

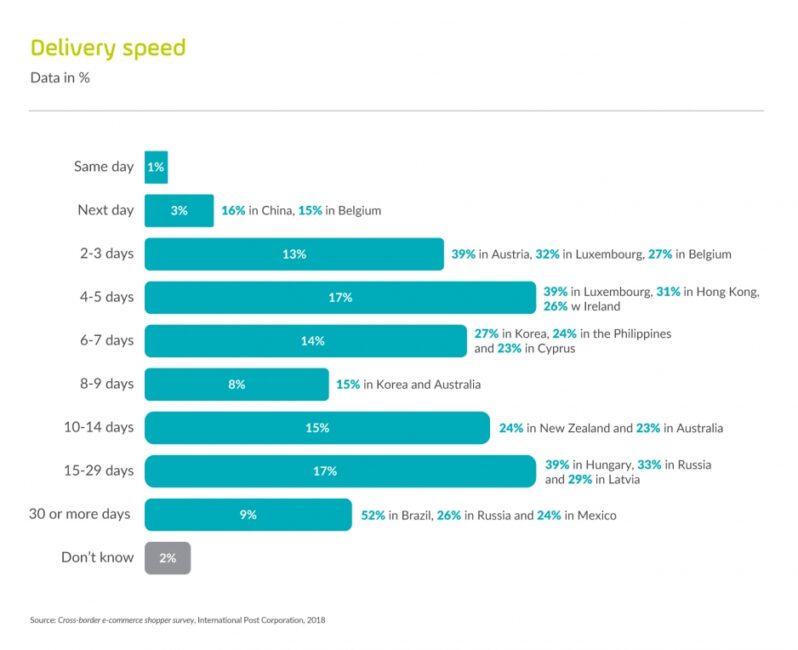

According to the same survey, 18% of the respondents received their cross-border parcels within 3 days from order placement, and 48% – within a week. The delivery time differed depending on the distance to be covered by the parcel. 9% of e-consumers waited for more than 30 days for the ordered goods. Most of them were from Brazil (52%), Russia (26%) and Mexico (24%) (4).

In this part of the article we will discuss the following practical aspects related to the launch of suitable logistics services for an online store that plans to develop cross-border sales and acquire more customers from abroad:

Before you start selling products to foreign customers, you need to make sure that the merchandise may be exported to the countries of destination. Some goods require special licenses or are simply deemed dangerous in a given country, and so they may be prohibited there.

In the world of logistics, all objects that can cause harm to the people who transport them are deemed to be dangerous goods. The International Air Transport Association (IATA) develops, in close cooperation with governments and airlines from all over the world, regulations that ensure safe transportation of such goods by air. On the IATA website you can find a useful manual containing up-to-date information on transport of dangerous goods.

If an e-seller offers products classified as dangerous goods, they need to prepare better for shipping such products abroad. Shipments with dangerous goods should be properly marked, and they often require also additional documentation. They also need to be treated more carefully in the freight forwarding chain, which may result in the carrier charging additional fees (5).

Cross-border shipping requires often also payment of additional customs duties and taxes by the owner of the online store or by the customer, before the product is delivered to the recipient. Governments levy taxes on parcels from abroad as they want to:

You need to check the customs and tax rates applicable in the country to which a parcel will be sent, and then multiply the percentage rates by the value of the parcel (5). It is worth remembering that:

Customs duties and taxes are quite a complicated subject matter. Logistics companies are aware of that and try to assist e-store owners to move in the maze of regulations. An example here can be DHL, which offers additional tools that facilitate cross-border selling:

The key to effective shipping is optimization of the method of filling orders. There are multiple options – from a global distribution center to tailored solutions that are fully adjusted to the needs of local e-consumers. Finding an optimum model depends, amongst others, on the customers’ preferences, the range of offered products, and the forecast online store development rate (6).

A very advantageous solution may be co-operation under the fulfillment model with a local logistics partner, which is an external company responsible for the entire process of order filling – from accepting an order that has been paid for, through packing, shipping, and fiscalization on behalf of the online store, to provision of customer service. Such a partner is usually based in the same country or on the same continent as the foreign customers whom online sellers want to acquire (5).

The best method for decreasing the costs of foreign shipment is using the services of multiple transport companies. Co-operation with only one carrier limits the possibility for e-consumers to choose between delivery options, which may ultimately result in higher costs of shipping, whereas local logistics companies may offer more competitive rates (5).

Offering various shipping methods enables also exceeding customers’ expectations and increasing their loyalty, which we have already mentioned in one of our previous articles.

To find the best logistics companies to co-operate with, you need to compare the prices, delivery times, and parcel tracking service quality they offer.

Tracking quality: it is advisable to choose a carrier which offers consignment tracking throughout the entire travel, irrespective of its stage. That will decrease the number of reports to customer service and the risk of losing a consignment abroad. Fortunately, most leading package delivery companies already offer such a possibility, which is a very important factor from the customer’s perspective.

Handling international returns is difficult, but it should be carefully thought through by each online store owner. As many as 67% of buyers check the rules of returning an item to an online store before making a purchase decision (5).

Here are some tips that facilitate foreign returns:

Using a platform for automated handling of returns. There is software that assists with configuring an automated returns process, which enables customers to generate and print return labels on their own.

An important logistic challenge is posed in cross-border e-commerce also by integration of tools and automation of processes. If you sell on multiple foreign markets at the same time, or provide several different language versions of your store website, or offer products on the most popular marketplaces in the world, you need to remember to simplify and standardize all the actions. It is worth wondering on how to make sure that all the sales channels and logistics systems (couriers, mail service, warehousing and accounting systems etc.) can be handled from a single location or with the use of a single tool.

There are integration hubs available on the market, designed for connecting to the largest marketplaces, carriers, logistics systems and sales platforms in the world (we described the most popular of them in our series of articles on e-commerce platforms). Examples of such tools include, amongst others, Nextsell, ErpBoz, Sellintegro or Base.com. The latter system accepts orders from all sales channels (both handled home and abroad), which enables the e-commerce department to manage them from a single location. Such a centralized system for handling orders enables automated shipping of consignments with the use of services of the largest in the world parcel delivery companies and post offices, but also running a warehouse with products and carrying out fiscal policy with the use of the most popular ERP systems. Base may be individually adjusted to the needs of a given company.

Also parcel delivery companies themselves make available to their customers tools for process automation. For example, at DHL integration with an online store is based on an API enabling full automation of sale processes in the area of logistics, and offers numerous possibilities to implement solutions that are useful to customers, for example tracking on the online store website. The most popular online store platforms, such as Magento, Presta, WooCommerce, IdoSell, as well as ERP systems or e-commerce systems, for example Base and Avocado Shipping, are integrated with the DHL’s API.

An interesting offer for smaller online stores which are not willing to integrate their systems with API may be the myDHL+ solution, which is a platform for shipping and tracking consignments and for comprehensive management of the relation with the logistics operator.

An important aspect that needs to be borne in mind is informing the buyer about the entire logistics process. Clear presentation of information on the time and cost of delivery, and on the carriers whose services can be chosen, are an absolute minimum. Publishing the rules of handling returns is also a good practice. A precise description of the entire process will help to build confidence in customers, who need to feel secure in order to be willing to order a product from a foreign online store.

Although logistics in cross-border e-commerce may initially seem to be difficult, it must be remembered that the operators of all online stores should become interested in obstacles to cross-border sales and should try to overcome them. It is worth considering all the available options of logistics policy, adapt them to the type of product being sold, the country to which merchandise is to be shipped, and the local customers’ habits. Next, based on the model which is most efficient for the business you run, an action strategy needs to be developed. That will enable online stores to meet the logistics challenges and to scale their business on a global level.

1) “Top challenges with cross-border e-commerce in the supply chain industry 2019”, Statista

2) “Cross Border E-Commerce Trends. Global Research Report”, Flow 2019

3) “E-commerce in Europe 2018”, Postnord, 2018

4) “Cross-border e-commerce shopper survey”, International Post Corporation, 2018

5) “Preparing your business for cross-border e-commerce”, Tommaso Tamburnotti, Bigcommerce.com

6) “The 21st century spice trade. A guide to the cross-border e-commerce opportunity”, Report DHL 2016.