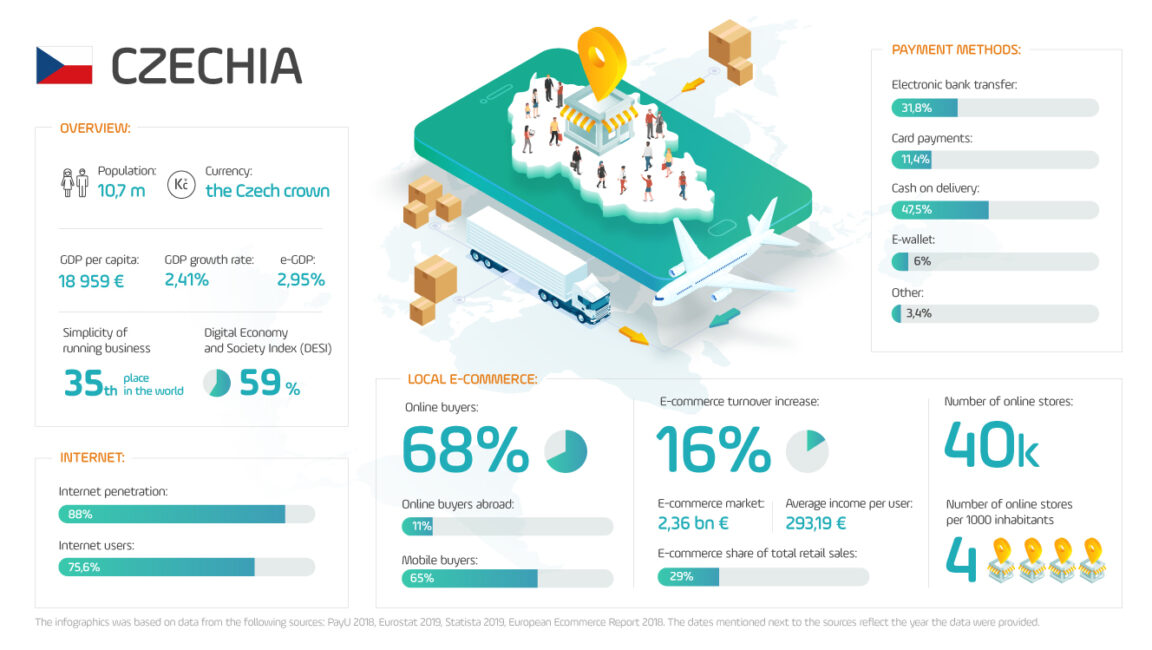

In the upcoming years we will witness rivalry for nearly 40 million consumers not shopping online yet from Poland, Czechia, Romania, Slovakia and Hungary. Polish e-commerce, with an excellent technological infrastructure and numerous mature webshops, has all the resources to address the needs of this group .

Joanna Pieńkowska-Olczak, PayU’s Country Manager Poland