-

Our solutions

- Our solutions

-

About us

- About us

- Partners

- Support

- Offer

Why are they a key to success?

Although cross-border e-commerce offers enormous business potential, any enterprise planning international expansion also needs to be aware of the challenges it will face when offering goods or services on foreign markets. One of them is the need to match the online payment infrastructure to the requirements of foreign customers who expect local, simple and convenient solutions that they already know well. At the same time, there are dozens of providers in the payments market offering e-stores various solutions, which unfortunately are often not local enough that large numbers of buyers would be able to use them.

Offering methods of payment in line with local trends and customer expectations is one of the key success factors for e-stores aiming for successful international expansion.

More than one-third of e-consumers worldwide state that access to local payments methods is a particularly important feature of a store when they take purchasing decisions.

It is especially important to online buyers in Eastern Europe and in some countries of Western Europe, including Germany, Belgium and Greece, as well as to those in Russia, India and South America. People living in these regions state that the online payment options an e-store offers are important – in many cases even more so than the options offered for deliveries or returns (1).

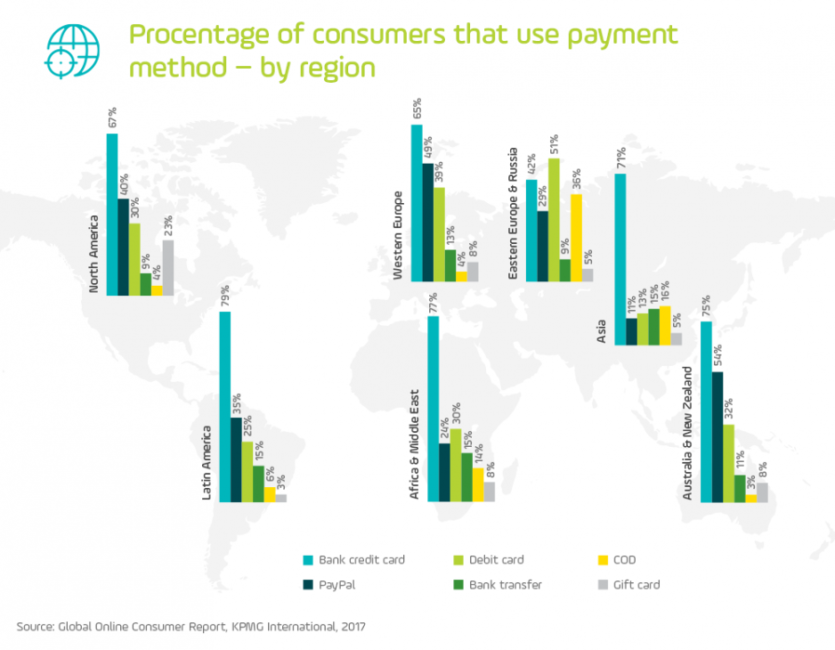

The most popular online payment methods throughout the world are credit cards and digital wallets, where the cash source is again a credit card assigned to the wallet.

Considering that in many markets, particularly those where e-commerce is growing the fastest – in many cases it’s a double-digit growth every year (for example in Asia, South America, and Central and Eastern Europe) – relatively few people have a credit card or bank account, e-stores should offer a much broader range of payment methods, particularly those based on local solutions. In this way they make shopping possible for hundreds of thousands of customers who would not otherwise be able to complete an online transaction.

In China the main tools used are Alipay and WeChat, while in other Asian countries it is credit cards that dominate. In India, e-consumers making online payments most often use debit cards – similarly in Russia, where credit cards have the lowest popularity (1).

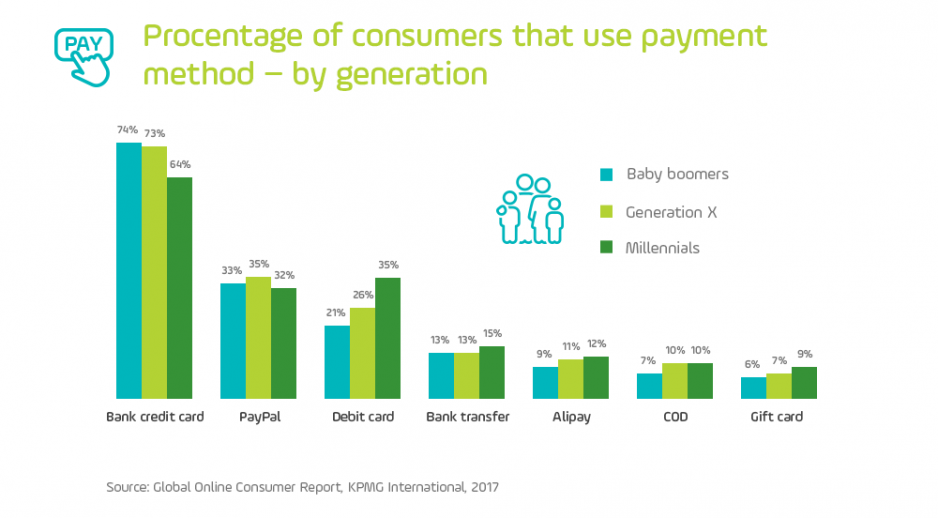

It is interesting to look at preferred methods of payment depending on age. Compared with Generation X and the baby boomers, the millennials, born in the 1980s and 1990s, use credit cards less often. It is not clear whether this results from conscious choices not to buy on credit, or from the fact that it is harder for them to obtain credit cards. Nonetheless, in order to attract younger customers to an e-store, it is especially important to offer a variety of payment options (1).

From specific regional preferences for online payments, to different levels of smartphone saturation – no two markets are the same. Every country and region is different, certain payment providers are more popular than others, and customers have their own buying habits. Payment methods alone number in the hundreds worldwide. Businesses that do not try to understand local behaviours and needs will not be able to expand in foreign marketplaces.

One of the main success factors in cross-border commerce is offering convenient and familiar online payment methods to foreign customers. In addition to this, accepting payments in local currencies is equally important.

A key to success is harmony between local and global activity. E-businesses should be aware that by offering customers different payment options, they not only consolidate their position in that market, but also increase consumer trust.

Effective strategies for foreign expansion are focused on providing consumers with the best possible purchasing experience, and local online payments help create that experience.

Firms that do not follow the rule of offering local solutions may in some cases lose access to more than 80% of the consumer market (2).

This is particularly important in high-growth markets, where traditional payment methods such as credit or debit cards have not yet attained a significant position. For a customer in such a region, the absence of alternative payment methods may cause some frictions in the purchasing experience. On the other hand, for e-businesses that want to move into foreign markets, it may be a frustrating challenge to integrate their e-stores with payment options ideally matched to the expectations of local customers.

Brazil, for example, is the strongest economy and largest e-commerce market in South America. However, as many as one-third of its inhabitants have no bank account and no card. For such consumers, a special online-offline payment method has been created, known as Boleto (described in more detail later in this article). In Poland, on the other hand, the most popular payment method is fast, real-time bank transfers (pay-by-link), used by as many as 62% of Polish e-consumers.

Meeting customers’ needs for local payment options is a complicated process, which can sometimes prove to be a burden for e-store owners who try to operate at a global level. A convenient solution in such a case may be a global aggregator of payment providers, such as the PayU Hub platform.

Every region of the world where e-commerce is currently developing most strongly, and in particular every country classed as a high-growth economy, is characterised by a distinct approach to online payments among e-consumers. Below we consider several examples that illustrate customers’ payment preferences in selected parts of the world.

Brazil has the most highly developed e-commerce market in South America. The most popular online payment method in that country is the credit card. Around 10% of all online transactions are paid for using local Brazilian credit cards, such as Elo and Hipercard. Although Brazilians are accustomed to using their credit cards for online purchases, almost 80% of payments of this type are made in instalments.

More than 25% of all online transactions involve alternative payment methods, including the popular Boleto Bancario, a cash payment method regulated by the Brazilian Federation of Banks. A boleto (ticket) may be paid for in millions of locations, such as ATMs, bank branches, lottery agencies, post offices, supermarkets and corner shops. Boleto is an important payment option to be offered to Brazilian customers, as it makes online purchasing available to the almost 30% of people who have no bank account.

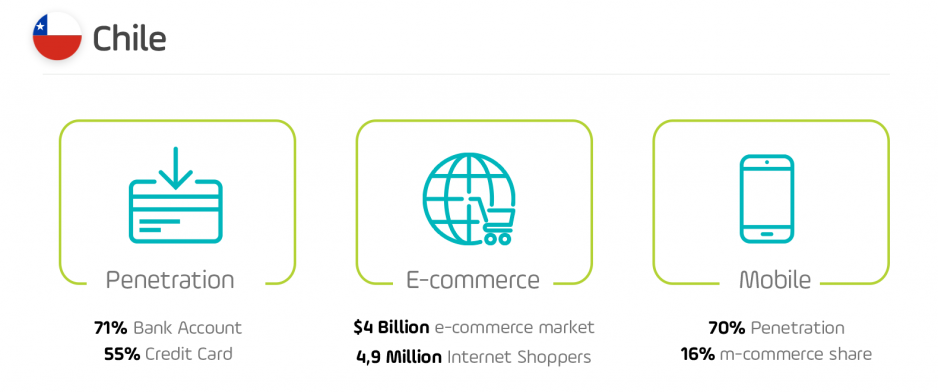

Chile is regarded as one of the most stable and advanced economies in South America. Accompanied by the highest levels of Internet and smartphone penetration in the region, relatively high penetration of credit cards and continuously increasing trust in online purchases, the e-commerce market in Chile provides many expansion opportunities. The online payment landscape in Chile is dominated by credit cards, which account for more than a half of all online transactions. In this respect Chile, in spite of its small size, is regarded as quite advanced among the countries of the region. Cash remains a popular and reliable method of payment, as in most other South American countries.

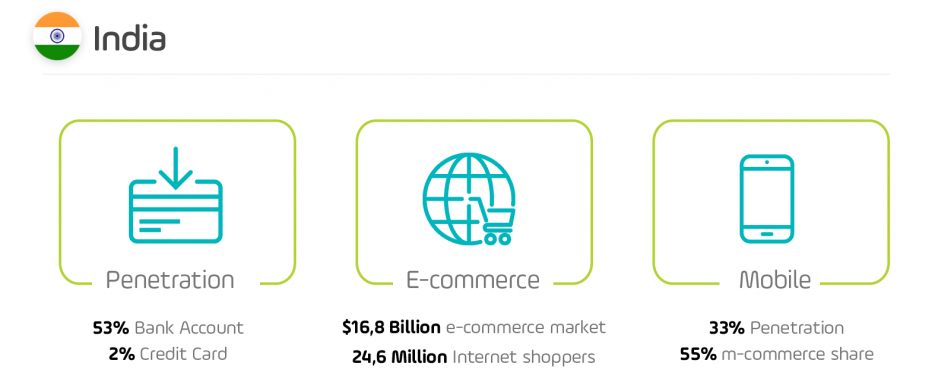

India is the second most populous country in the world and has the fastest developing e-commerce market. According to forecasts, with an average rate of growth of 30% annually, the value of the e-commerce market in India will reach 103 billion US dollars by 2020, of which around 50% will come from cross-border e-commerce. Among the factors behind this success is the impressive number of smartphones coming to be used by online purchasers – India is the second largest smartphone market in the world.

In the past three years the number of online payments in India has grown markedly. A huge influence on this has been the intensive demonetisation, involving the withdrawal from circulation of the most popular 1000 and 500 rupee banknotes, announced by the Indian government in November 2016. As a result of this there was a significant rise in numbers of credit and debit cards issued, and also in the number of online transactions completed using cards.

The local Rupay debit card accounts for 38% of the total debit card market in India. It must be borne in mind that this card can be offered only through local payment agents. As regards Indian methods of payment by online bank transfer, a very popular option is Netbanking, which is used three times as often as card payments, as well as the Unified Payments Interface (UPI) system. The government-supported UPI initiative has come to dominate the digital payments landscape, and is currently offered by as many as 90% of e-commerce businesses in India. Another extremely popular and convenient payment method in India is digital wallets: their share of the market in online transactions increased by 500% in 2014–2016.

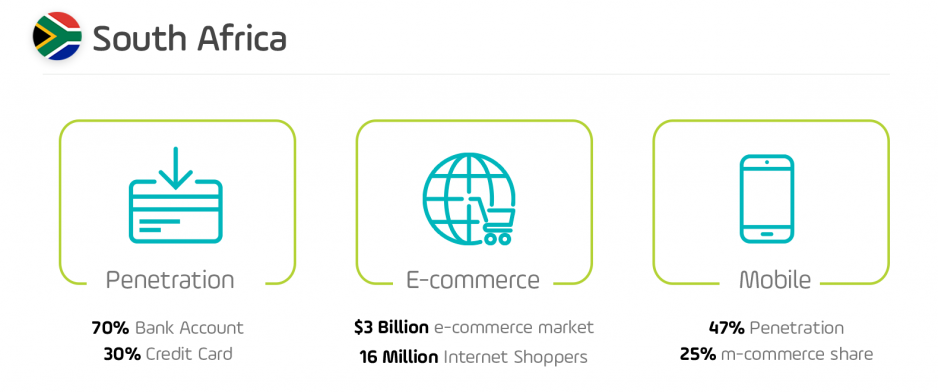

South Africa has the most highly developed digital economy in Africa and one of the fastest expanding anywhere in the world. People in that country are moving rapidly away from cash to online payments, thanks to international payment methods as well as strong local players. Credit and debit cards are currently the most widespread online payment methods, but South Africans are more and more frequently opting for alternative solutions. The above-mentioned PayU Hub enables acceptance of payments by Visa and MasterCard, irrespective of where those cards were issued. PayU also handles online transfers from all banks in South Africa, and this greatly increases possibilities of purchasing products for those customers who do not have credit cards.

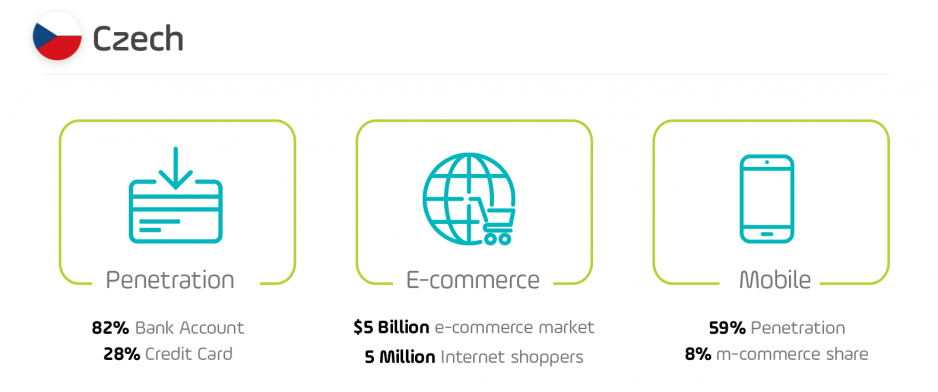

The Czech Republic is a fast developing economy in Central Europe, with e-commerce turnover amounting to 5 billion US dollars. There is also rapid growth (of 39%) in cross-border e-commerce, putting the Czech Republic among the three EU countries with the largest growth potential in this area. The main factors behind the expansion of e-commerce are high Internet penetration (88%) and the huge penetration of smartphones (59%). These data help explain the rapid growth observed in m-commerce – visits to e-stores using mobile devices have doubled over the past two years.

The dominant payment method for Czechs buying online is still cash on delivery, even though more than 82% of the population have a bank account. Credit cards are used for 17% of online transactions, but this figure is expected to rise in the coming years, as credit cards become the preferred method of making payments. E-businesses aiming to enter the Czech market should also offer their customers the possibility of paying for purchases with fast bank transfers (pay-by-link) via all 10 local banks.

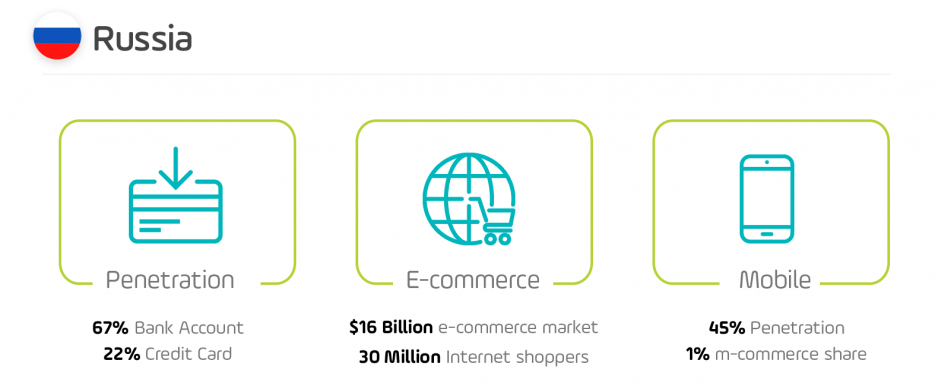

Russia is one of the most favourable places in Europe for the development and rapid growth of an e-commerce business, driven by flourishing mobile-based and cross-border sales, as well as a general openness to digital purchases in both urban and rural areas. Russia also has the continent’s largest population of Internet users, numbering 90 million, of whom 30 million regularly make purchases online. This leaves huge scope for future expansion.

A visible trend in Russia is a preference for buying from foreign stores – cross-border transactions account for 37% of all online transactions in that country. A motivating force is the exemption of international firms from taxes and duties on goods for personal use. Global businesses are not obliged to set up a local branch in order to operate in Russia.

Credit and debit cards are just as popular in Russia as in other countries of Central and Eastern Europe. Visa and MasterCard have a presence there, as do local cards issued by the Bank of Russia. E-wallets are especially popular – they have been present in the market for almost 10 years, and are very useful in e-commerce. Domestic operators like Yandex Money, Qiwi (in cooperation with Visa) and WebMoney provide customers with simplified and convenient methods of paying online. To give Russian consumers the best possible purchasing experience, it is very important that e-stores enable access to the locally preferred methods of making payments.

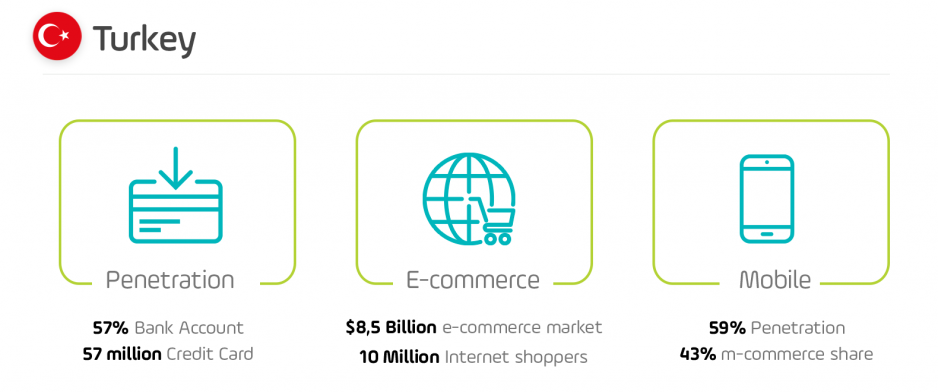

As the 17th largest economy in the world and the third fastest developing e-commerce market in Europe, Turkey offers excellent opportunities for cross-border investment by e-stores from other countries.

In Turkey more than 70% of card payments use instalment schemes, which enable customers to spread their expenses on everyday purchases over monthly instalments. Also hugely popular are loyalty cards with a payment option, and this is certainly a method that ought to be offered to Turkish consumers by any firm moving into that market. This payment method is largely controlled by the seven leading providers, who account for 94% of the market. Instalment payments are offered only by local payment providers (including PayU and iyzico) or by global platforms serving as aggregators of local payment systems (such as PayU Hub).

It is important for e-businesses to make sure that an organisation which processes payments for them complies with Turkish laws on data storage, which require data on local consumers to be stored within Turkey.

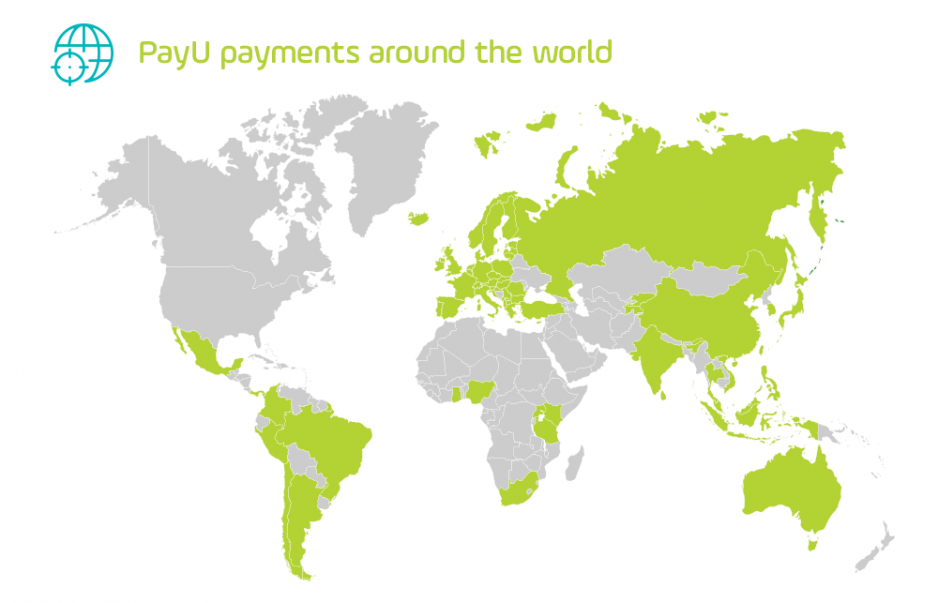

The map below shows details concerning the global presence of PayU, which supports numerous of e-businesses in their international expansion:

Cross-border selling is one of the hottest trends in e-commerce. However, offering goods and services to customers abroad comes with many challenges. One of these, without doubt, is the need to integrate suitable payment methods.

When deciding to expand into European markets, a business may successfully make use of, for example, the system provided by PayU to handle directly all transactions in the EEA (the EU together with Iceland, Switzerland and Liechtenstein). In addition, for traders whose aspirations stretch even further, the global PayU Hub platform has been created. Integration with this platform enables a firm to accept payments in countries all over the world, including the use of local payment methods that represent alternatives to credit cards in such promising markets as India, Brazil, Nigeria, Russia, Turkey, and the whole of South-East Asia.

Through PayU Hub you can gain access to more than 250 local alternative payment methods (APMs) by means of simple integration with just one API.

Giving consumers a wider range of payment methods, including the solutions that are well known to them on their local market, has a positive effect on a conversion rate, and helps increase customers’ trust, leading to more international transactions carried out in local currencies.

The following are mechanisms that ensure a higher number of positively completed transactions:

What’s for merchants in offering alternative payment methods handled in local currencies?

The development of technology is opening up new opportunities for online businesses, and means that nothing stands in the way of e-stores wishing to expand their operations into new geographical regions. Although serving global customers is still a challenge, the processing of international online payments has never been easier. The most advanced payment providers are offering solutions that mean that customers in all markets are able to perform online transactions even when the store is based in a different continent.

1) The truth about online consumers. Global Online Consumer Report, KPMG 2017

2) The rising challenges and opportunities of cross-border trade, International Finance, 03.2019

3) Going Global: The Ecommerce Era, PayU & Raconteur, 2018