-

Our solutions

- Our solutions

-

About us

- About us

- Partners

- Support

- Offer

Statistics, trends, market characteristics.

The potential of Internet-based commerce is growing – already 1.92 billion persons all over the world shop online. At the same time, increasing numbers of e-consumers shop outside the borders of their countries. We have started describing the phenomenon of cross-border e-commerce in our previous articles, presenting the buying behaviors of our European neighbors: Cross-border sales in e-commerce – why does it make sense to sell goods to other countries? and The shopping habits of our European neighbors. Cross-border sales in European countries.

This time we would like to focus on the characteristics of e-buyers from other parts of the world. We describe selected regions, such as: South America, North America, the Middle East, Africa, Asia and Pacific region, and individual countries: Brazil, the United Arab Emirates, Israel, Nigeria, which are significant and relevant in the context of cross-border e-commerce.

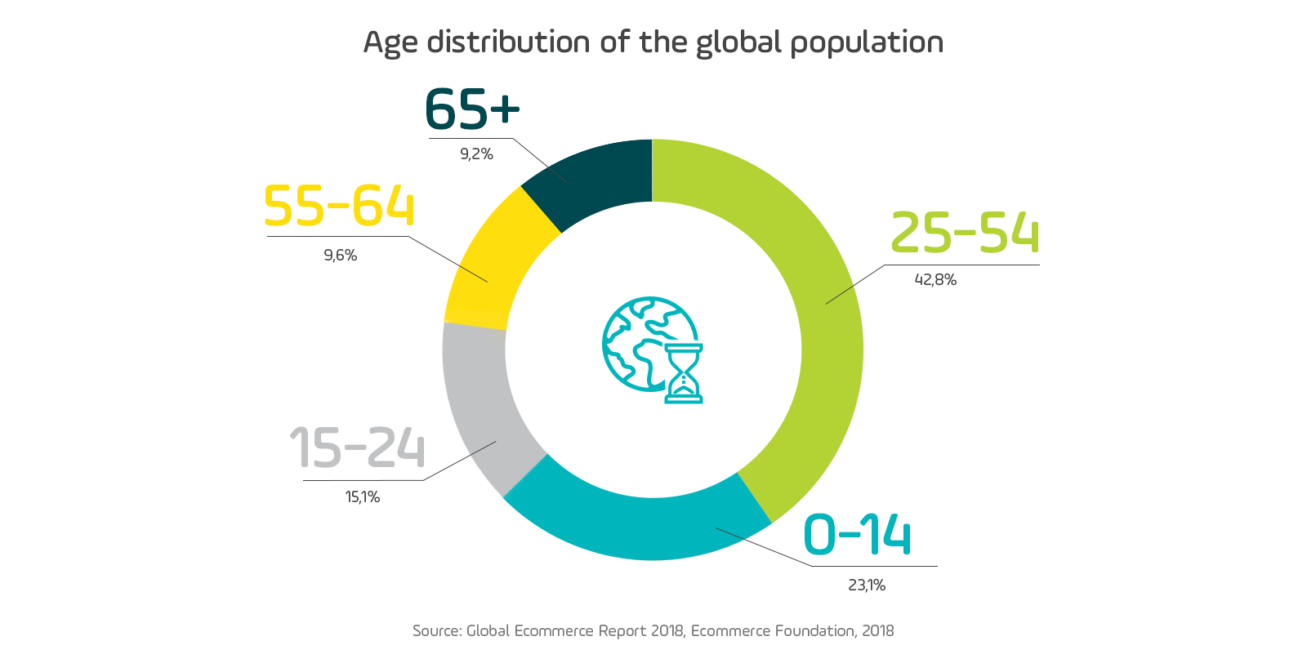

The global population is constantly growing – currently it amounts to more than 7.6 billion people. Almost half of this number is aged between 25 and 54. Among this group, the largest number of online transactions is concluded by representatives of the so-called Generation X – consumers born between 1966 and 1981. On the average, representatives of this group have shopped on the Internet almost 19 times during the past year. The younger group, the so-called Millennials, born in the 1980s and 1990s, have made 20% less transactions. 1

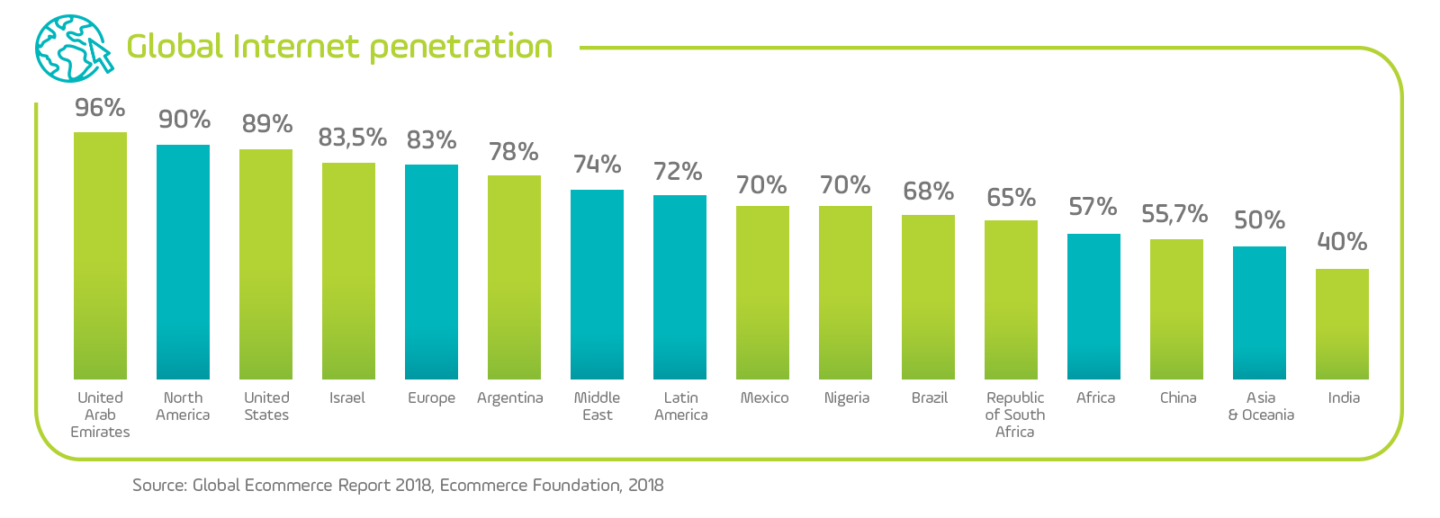

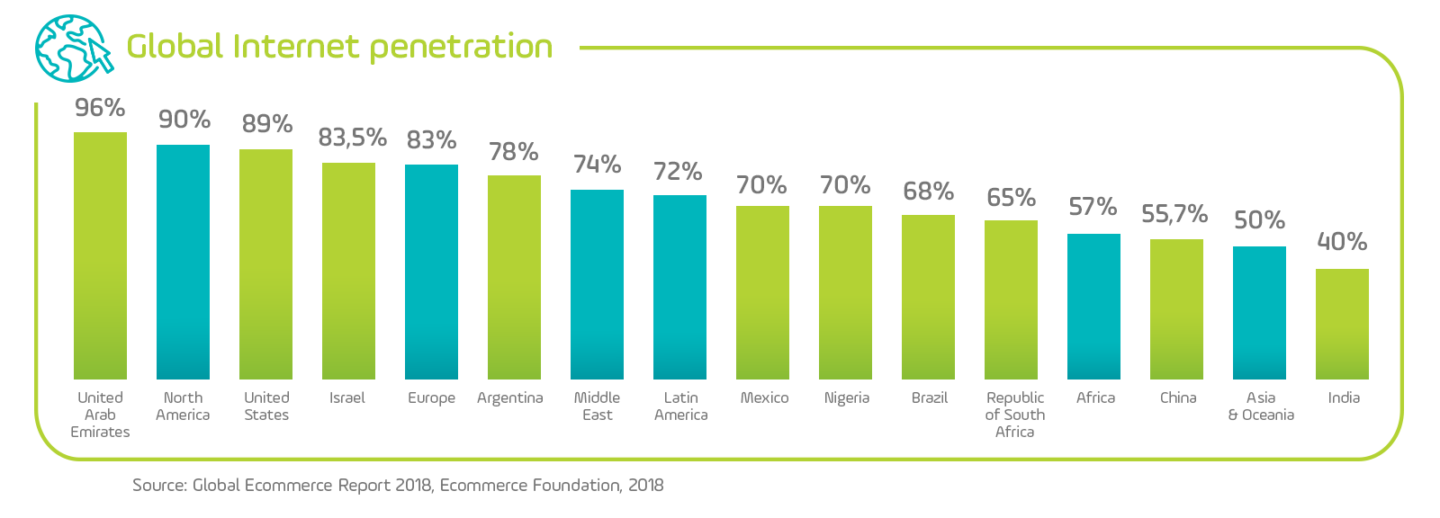

As the global population grows, so does, steadily, the Internet penetration – almost 60% of all households all over the world have Internet access (1).

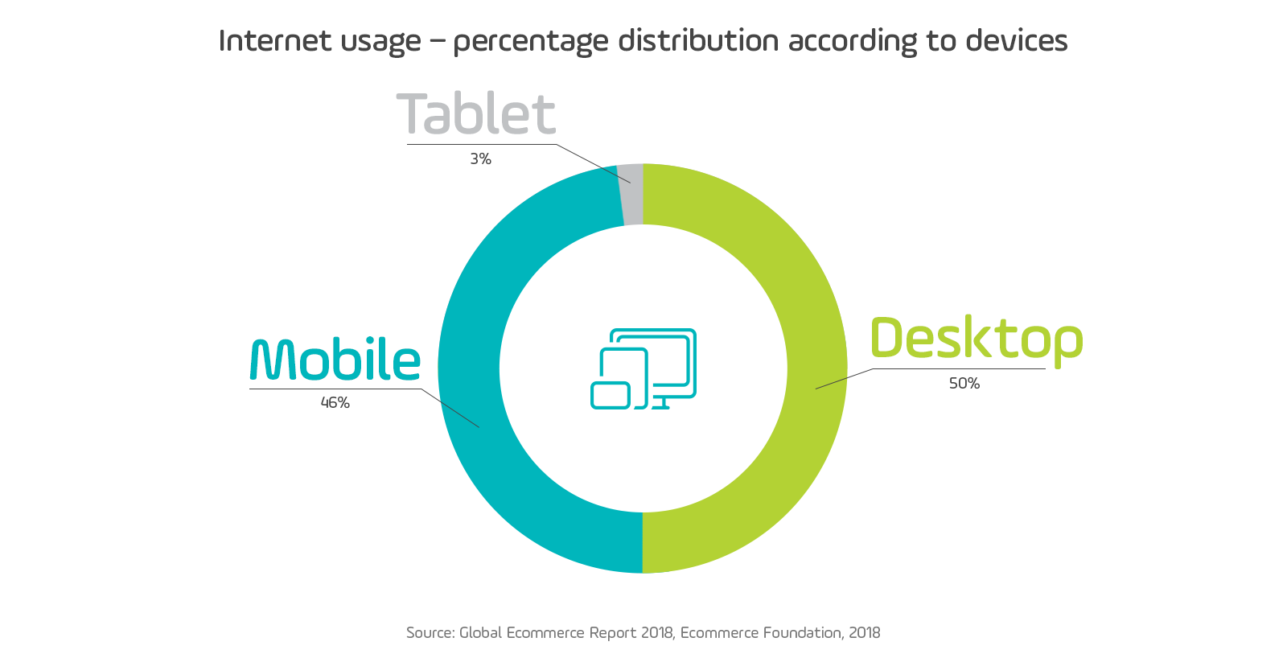

As regards devices used by the global e-consumers, both desktop and mobile devices (smartphones and tablets) are used with similar frequency. Although most transactions in online stores is still done via PCs, it is advisable to keep in mind that the customer’s purchasing path covers all channels. Therefore, the development of online stores that allow the consumers to enjoy shopping on mobile devices, should currently be one of the most important aspects in the development of each e-commerce undertaking (1).

There are several indicators that describe the degree of advancement of a given country in terms of Internet and -ecommerce development. A few of them have been named in the Global E-commerce Report:

The frequency of online shopping differs depending on the continent. Research conducted with e-consumers in 41 countries all over the world suggests that one fifth of them shops at e-stores on the average once per week. The largest frequency is found in Asia and the USA, while Europeans do it the least frequently.

Location of delivery is one of the most important factors that determines satisfaction with online shopping. The physical locations where the ordered products are delivered, as well as consumer preferences regarding delivery, differ across the world.

The most frequently selected form is home delivery (68%), ranging from 86% in the Netherlands to 30% in Russia. Next in terms of popularity is delivery to a post office (23%), which is selected the most frequently in Russia (74%), Iceland (62%) and in Latvia (61%). Collection at a postal services point (16%) is the most popular in Scandinavia – Sweden (67%), Norway (67%), Finland (56%) and Denmark (45%). Collection at a courier services point (13%) is used the most frequently by the French (46%) and Danes (29%). 10% of all consumers decide to have their purchases delivered to a post box station (such as the Paczkomat – Automated Package Machine – in Poland). This form of delivery is used the most frequently in Finland (40%), Denmark (36%), Latvia (35%) and China (32%) (2).

As far as assessment of delivery location in terms of convenience goes, home is rated as the most comfortable place (59%), next comes a safe place at home (22%), the workplace (18%) and an alternative collection address (18%) (2).

When offering products to foreign customers, it is also advisable to pay attention to additional aspects of sales and new factors that encourage e-consumers from other countries to buy. Sustainable development is one of the most important trends – an increasing number of buyers pay attention to environment-friendly packaging or carbon-neutral shipment methods. 27% of respondents in a survey conducted by the International Post Corporation stated that they care for sustainable delivery methods, and 22% are able to pay extra for them.

Countries where e-purchases were made.

Source: Cross-border e-commerce shopper survey, International Post Corporation, 2018

Categories of products most frequently bought online, all over the world:

Interestingly, the top 5 of most frequently bought product categories frequently differ from country to country. For example, in Austria and in Belgium wine is the product that is bought online the most frequently, food products in Great Britain and in China, while in Brazil and Greece – medication and pharmaceuticals.

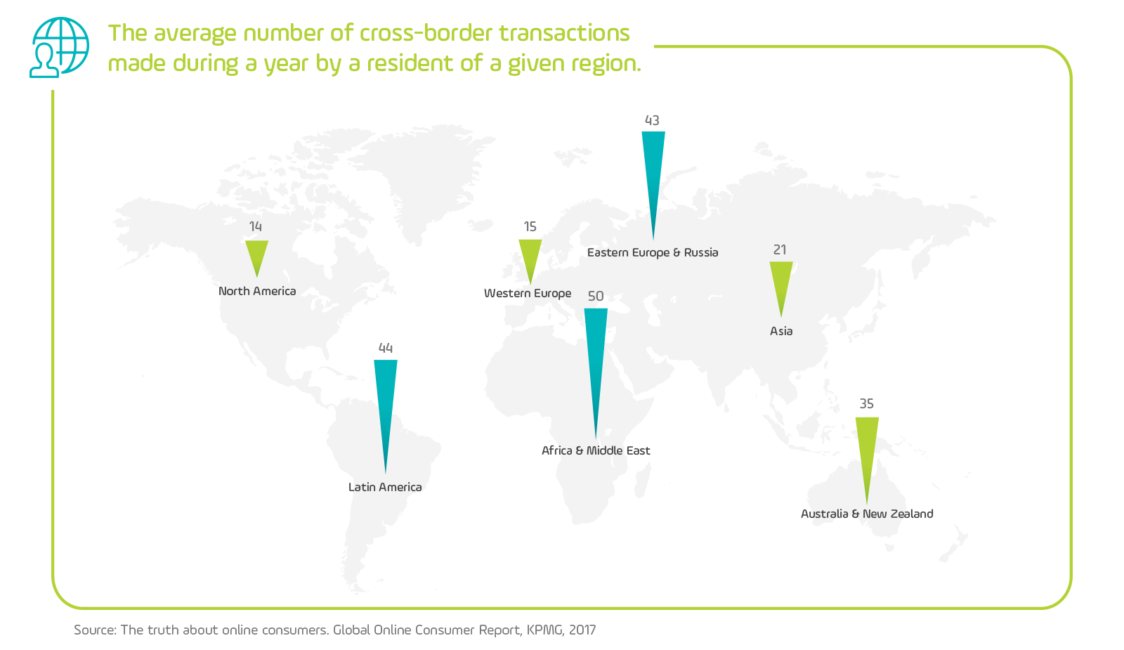

The e-consumers from North America and Western Europe engage less in cross-border shopping than their peers in South America, Eastern Europe, Asia or Australia – cross-border purchases constitute, respectively, 14% and 15% of their total online shopping. This result should not come as a surprise, because both markets are very mature and the most popular products can be found at competitive prices in the countries of residence of the consumers (3).

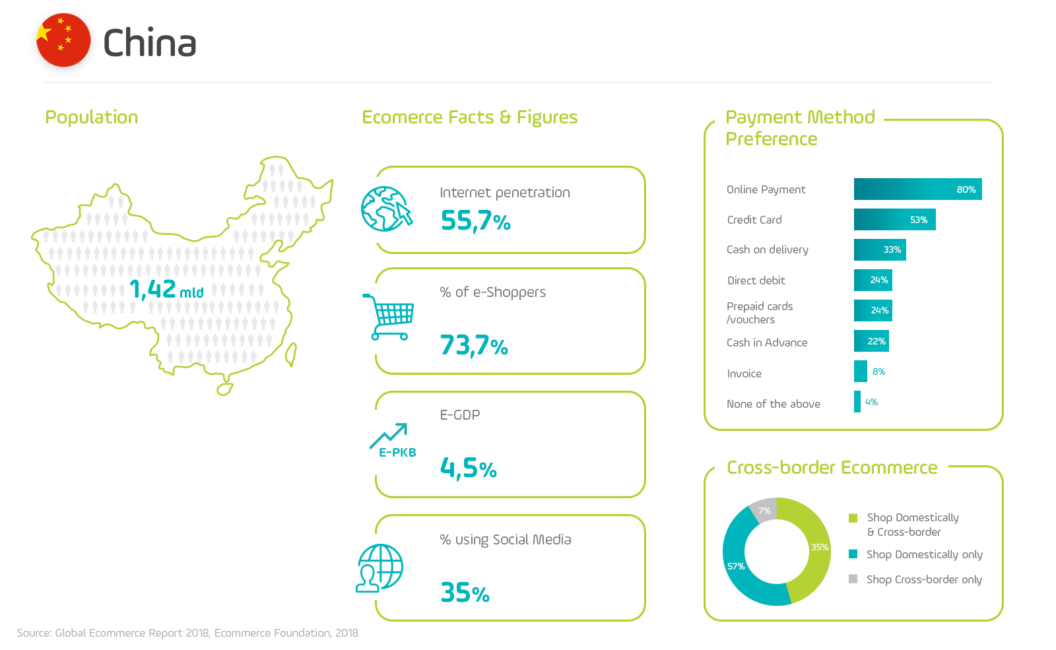

Import of products from outside Asia amounts to 21% on the average – although this value differs significantly, depending on the country. In Hong Kong, Singapore and Vietnam the cross-border purchases account for, respectively, 31%, 43% and 55% of all online shopping. For the Indonesians, Japanese and residents of India the proportion is only 12%. China, with their cross-border e-purchases imported from outside Asia at 20%, falls in the middle of the range (3).

In Australia and New Zealand, the percentage of online purchases imported from outside that region reaches 35%, of which 25% of e-purchases come from North America and Europe (3).

The regions where consumers most frequently engage in cross-border e-shopping are: Eastern Europe and Russia (43%), South America (44%) and Africa and the Middle East (50%). Special attention should be paid to e-consumers from the United Arab Emirates – as much as 58% of their online transactions are purchases made in e-stores from other regions: Asia, North America and Western Europe. In Eastern Europe and in Russia, the largest proportion of ordered goods comes from Asia (15%), Western Europe (13%) and North America (8%). In South America, almost 60% of products bought online come from North America (3).

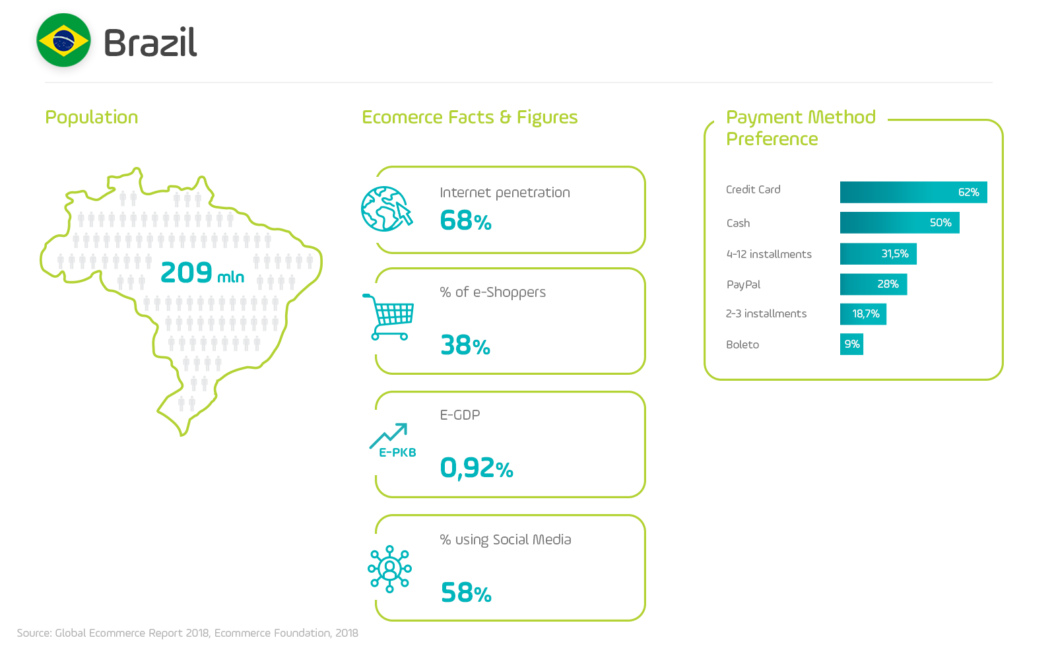

South America is a region frequently overlooked by companies exporting their goods, probably due to the relatively small ratio of market penetration by e-consumers (26.8%). 1 But this is precisely the factor which determines the huge opportunities in this region, which develops faster than Europe and North America. An increasing number of households are connected to the Internet – in 2018, their proportion reached 72% (1).

A relatively new phenomenon in this region are smartphones in the mass market. Their falling prices and increased accessibility resulted in rapidly increase of the numbers of smartphones in the region during the recent years. Due to these tendencies, the mobile ecosystem of South America will increasingly contribute to changing the region’s economy over the coming years. 1

The most popular online shopping sites:

The Brazilians have a tendency to purchase via the so-called marketplaces and websites offering group shopping deals. They also like to use websites with discounts and coupons. Many consumers are aware that online product prices and customer service are better than in physical stores (1).

Companies which consider entering the Brazilian market should think of registering their e-stores with domains ending with .br, which are the so-called Top-Level Domains in Brazil.

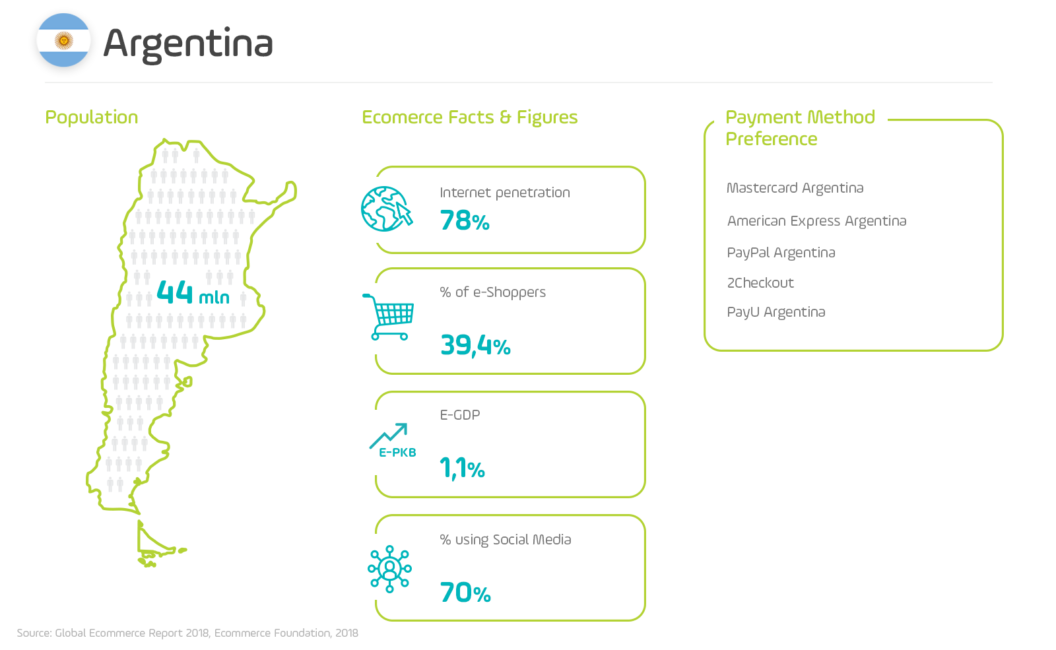

Argentina is a very rapidly developing market – it is the third largest mobile telephone market in South America, with 61 million mobile connections. According to forecasts, access to broadband mobile Internet would rise to around 75% in 2020, and smartphone penetration would reach 71% (1).

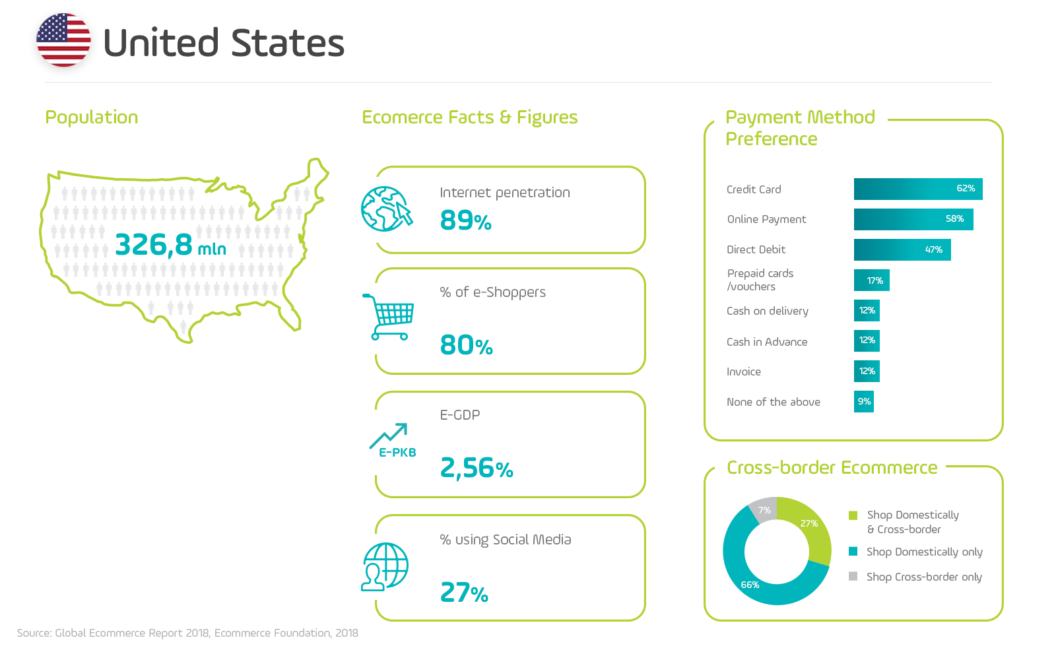

North America is a very interesting market in the context of e-commerce, because due to its size it varies strongly, both in terms of maturity of online shopping and the preferences of e-consumers. This region certainly stands out with its world’s highest ratio of social media usage – it amounts to circa 66%, while the global average is circa 37%. Another important factor is the access to broadband Internet, which is found in more than 90% of households (1).

The most popular online shopping sites:

More than 77% of e-consumers from the United States are already shopping online, and 32% of them have decided to buy goods imported from another country. The USA is an example of excellently developed e-commerce market, which registers a 13% increase in value, year-on-year (4).

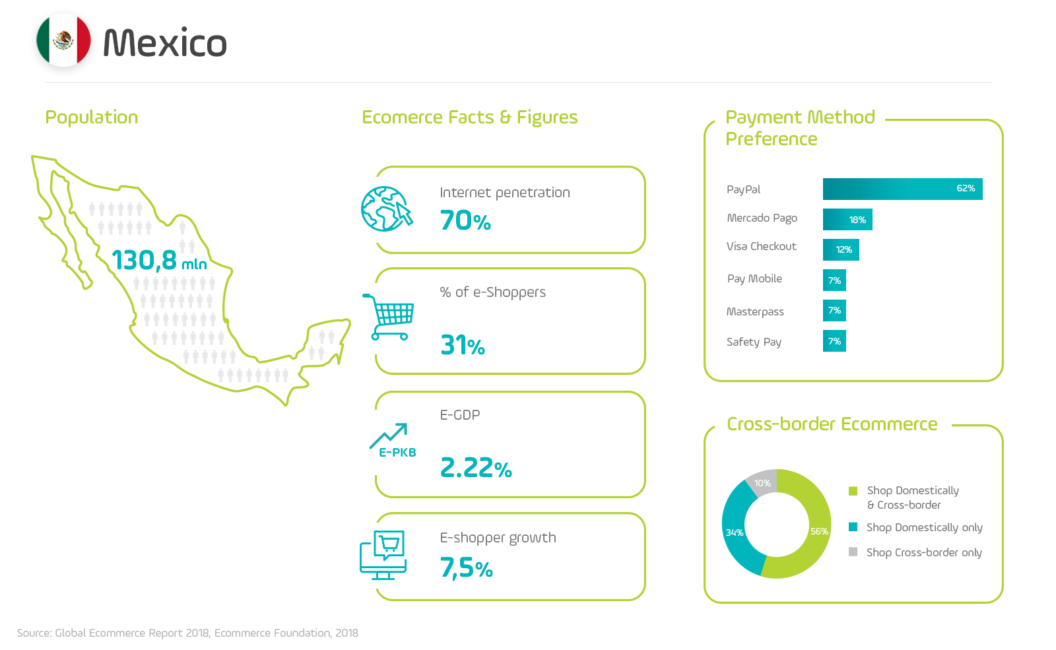

Mexico, similarly as Brazil, has a relatively low market penetration by e-consumers – only 20% of its population of 130 million shop online. However, from the standpoint of cross-border e-commerce this is a very interesting market, which grows quickly, boosts Internet connectivity, improves logistics and continually develops its knowledge of digital technologies (1).

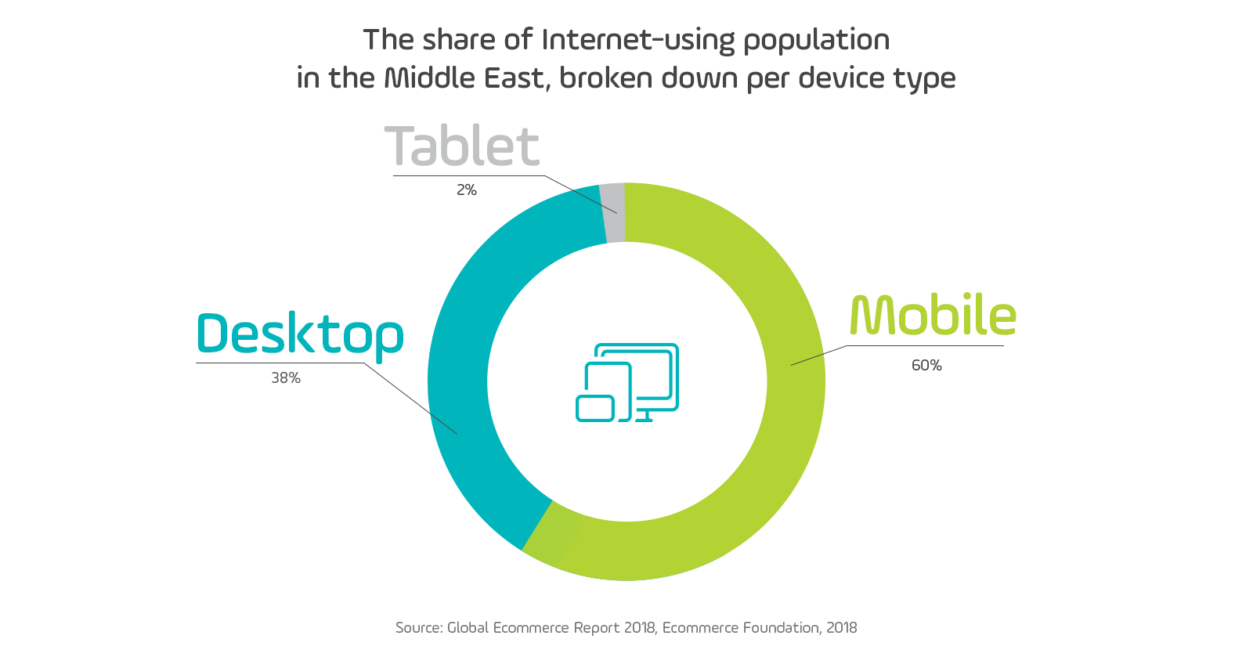

The one feature that makes the Middle East stand out among other regions discussed in this paper is the large number of persons using mobile devices – more than 62% of Internet users use smartphones and tablets. 1 An increasing number of households are connected to the Internet – in 2018, their proportion reached 74%. 1 There are however several obstacles which make it impossible for this market to reach its full potential. They include lack of consumers’ trust in e-commerce, fears of problems with delivery and payment, as well as the government policies, unable to keep abreast with globalization. Governments in the Middle East are just learning to support the development of digital economy (1).

The most popular online shopping sites:

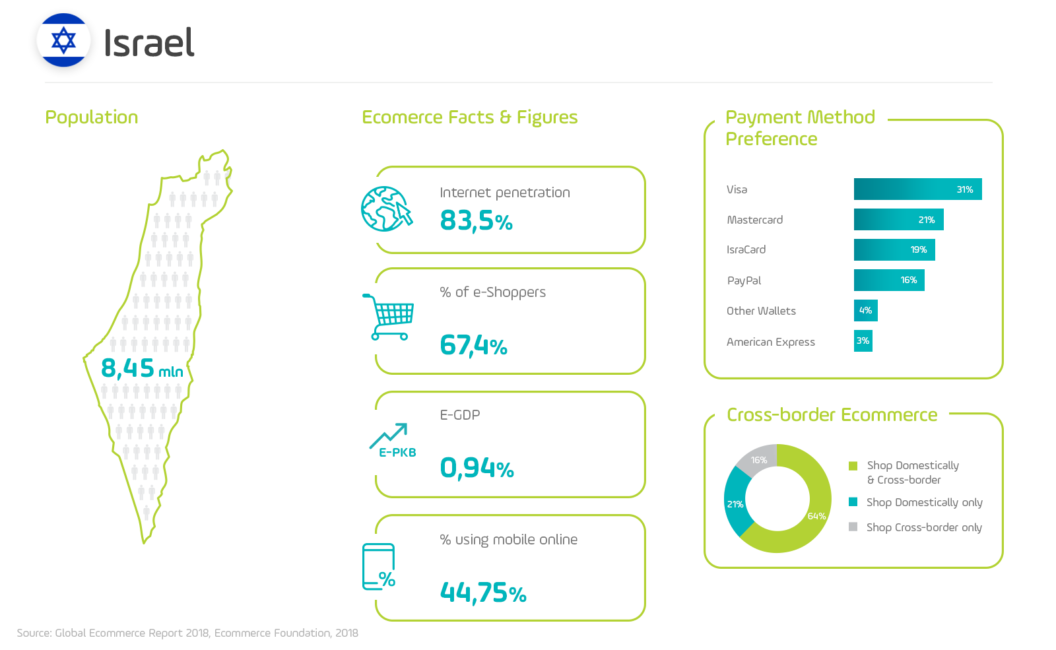

Israel is known for innovations and advanced technologies, but the consumer goods produced here are frequently of poorer quality and more expensive than those imported from other countries. That is why the Israeli gladly shop in foreign e-stores – from clothes and shoes to household items. 1 Interestingly, physical goods with value up to $75 are exempt from all taxes, and purchases up to $500 are exempt from VAT. That is why Amazon has to charge VAT on its virtual products, such as e-books, but not on physically printed books costing under $75 (1).

Most e-consumers in the United Arab Emirates have no problems with shopping online in foreign stores (60%). Over 70% of online shopping is performed by customers under 31 years of age. As much as 96% of households have access to the Internet (1).

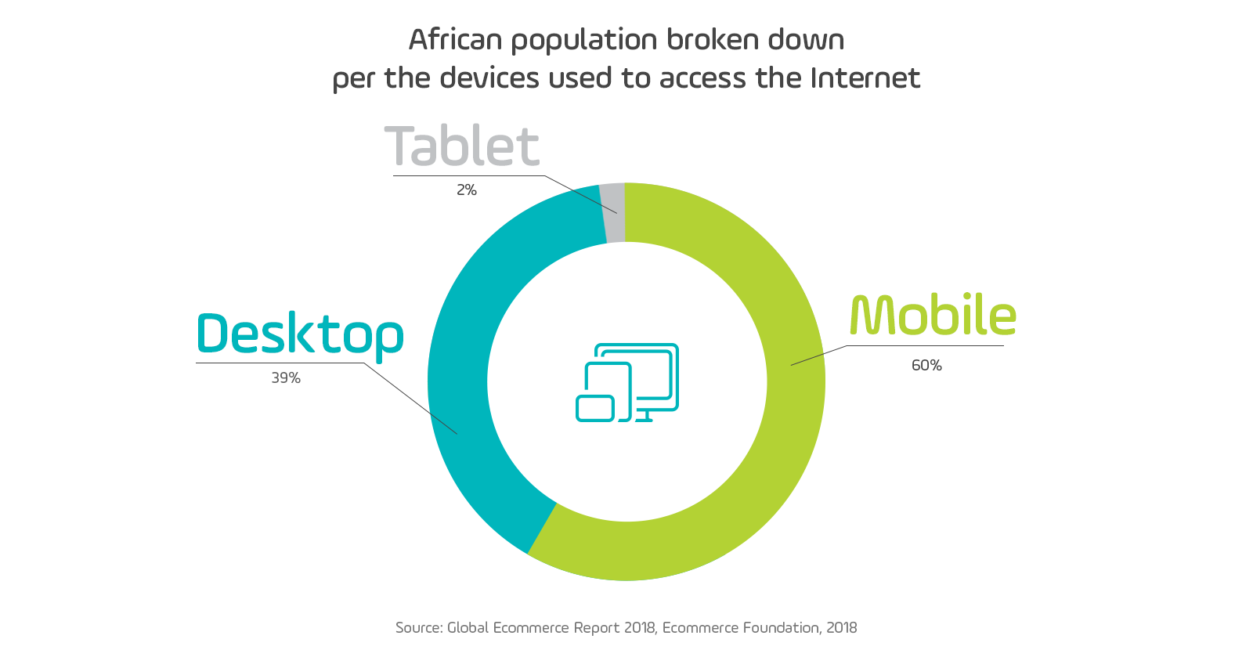

Africa is a huge market (1.2 billion of people, 65.4 million of online shoppers), which is just at the edge of a huge growth phase. Its potential has been successfully used by suppliers of mobile solutions and e-entrepreneurs, such as Jumia, Mall For Africa, PayU or M-Pesa. 1 The global entrepreneurs, who do not realize the opportunities offered by Africa, risk losing one of the greatest growth chances in the 21st century.

The appearance of mobile phones changed the lives of millions of people in Africa. For the residents of this continent, they are the first, and frequently the one way to contact the external world. More than 62% of the population use the Internet on their smartphones and tablets. 1 In the context of online sales in the African markets, it is necessary to keep in mind the domination of mobile commerce and mobile payments, which are the key to succeeding in the region (1).

An increasing number of persons have a fixed, broadband Internet connection – in 2018, their proportion reached 57%.

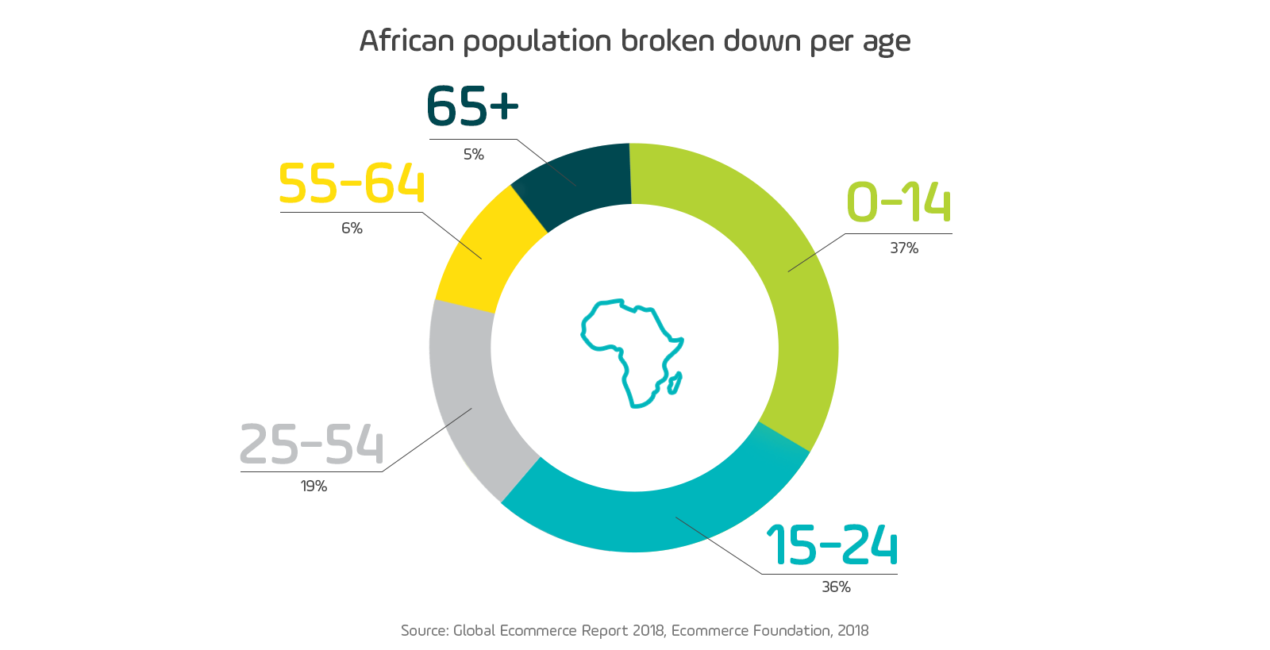

The data regarding age distribution of the African population are interesting – more than 37% are children, up to 14 years of age.

The most popular online shopping sites:

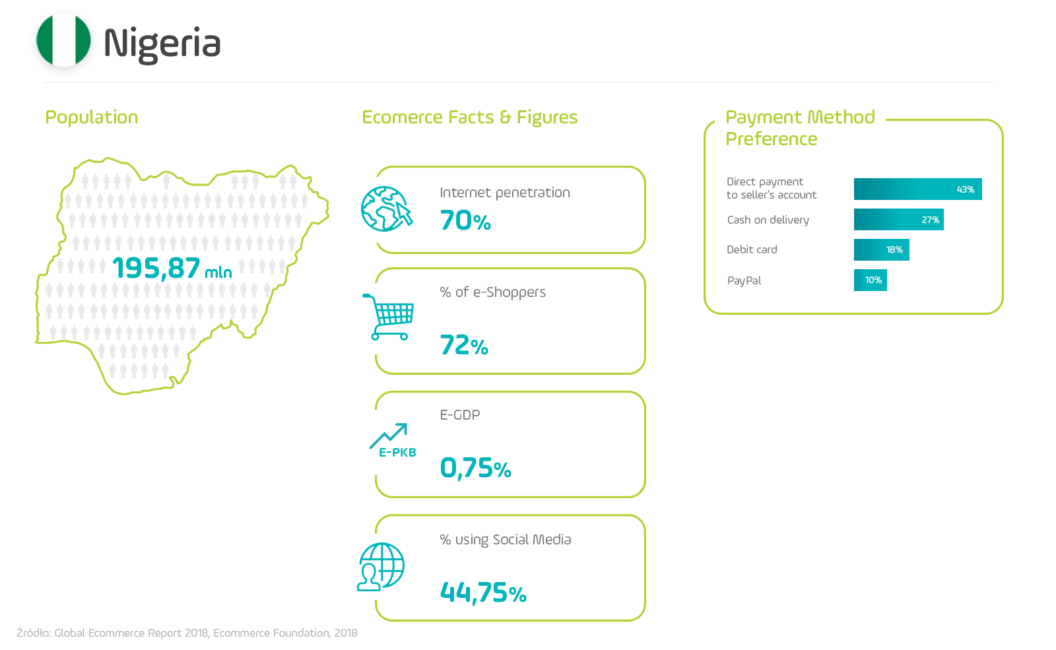

Nigeria is officially the most “mobile” country in Africa – 76% of all Internet traffic in Nigeria is generated by mobile devices, and around 26% of Nigerians participating in the surveys declare they made their online purchases using a mobile device. Interestingly, the Nigerians are very keen to celebrate Black Friday – the largest e-commerce event during the year (1).

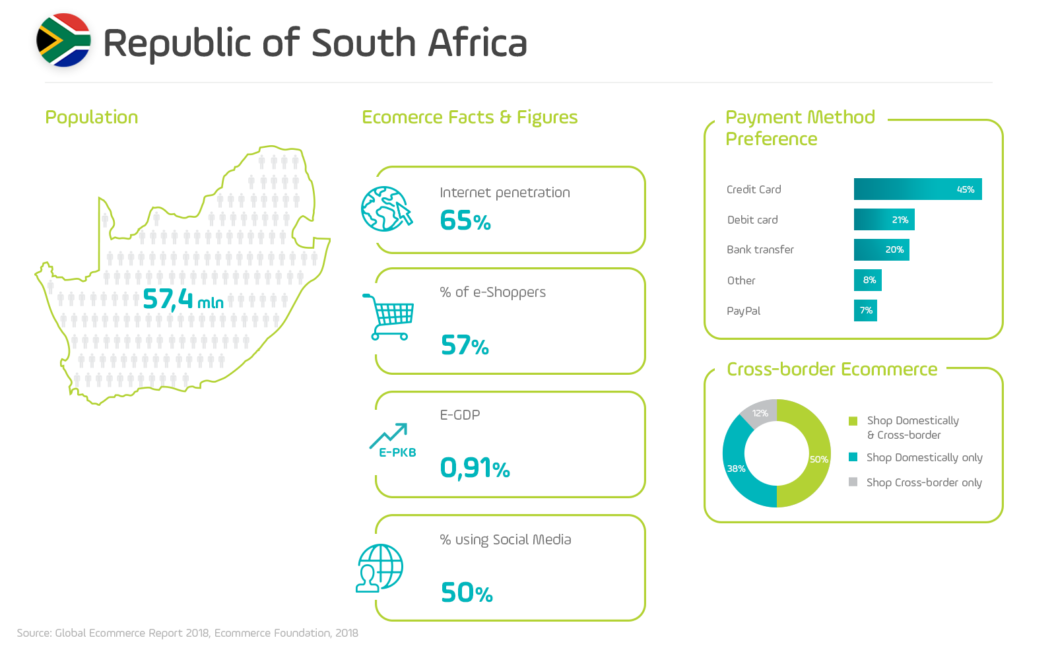

Research shows that cross-border online shopping is increasingly popular in South Africa – more than 50% of e-consumers have purchased products from foreign e-stores. The most frequently chosen countries of vendors are China, Germany and the USA. About 18% of respondents in South Africa declare they made their online purchases using a mobile device (1).

Statistics suggests that the region of Asia and Pacific keeps on developing strongly, accounting for around 40% of global e-commerce sales. This region is inhabited by 921.6 million e-consumers, of which the Chinese constitute 63%. Already more than 50% of households have access to the Internet (1).

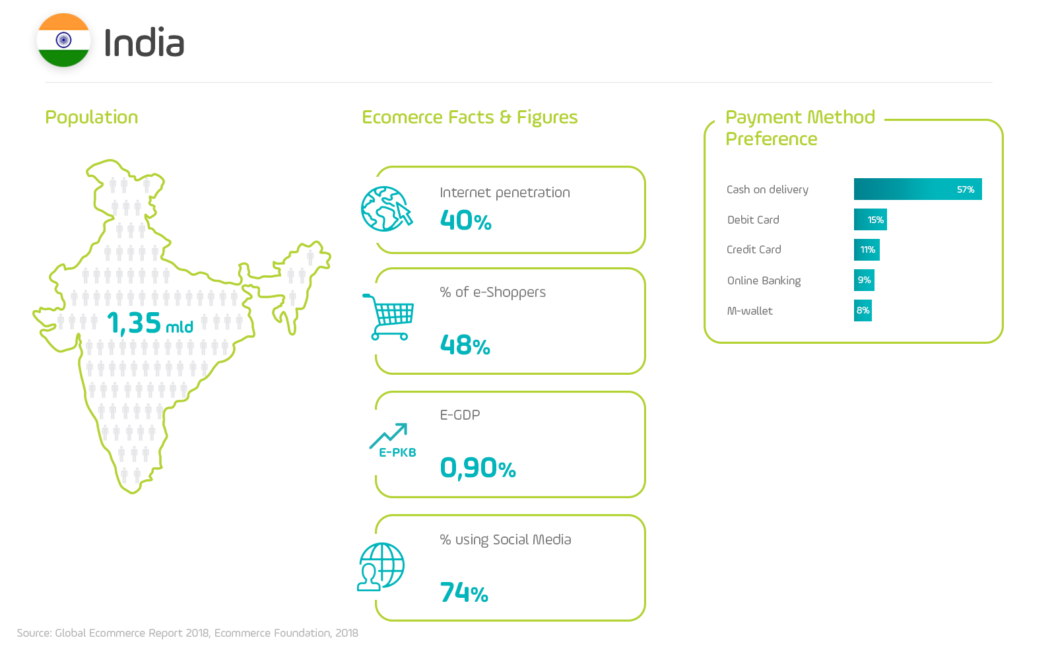

India is the second most populous country in the world (1.2 billion people) and the fastest growing e-commerce market in the world. The number of online shoppers amounts to circa 24.6 million persons. It is estimated that online retail sales in India would rise from the level of $15 billion in 2016 by more than 1200% by the year 2026, reaching the level of $200 billion. In 2016 and 2017, more than 4 million residents of India decided to purchase goods from foreign e-stores, and the value of cross-border e-commerce reached $7 billion. This value shall increase further – many products, such as electronic goods or cosmetics, are cheaper abroad than in India (1).

The Internet giants, Alibaba and JD.com, still dominate the local market, together accounting for more than 85% of the Chinese e-commerce market. The Chinese have missed the PC and laptop era – they started using the Internet at the time smartphones entered their market, and therefore they connect to the Internet mostly using mobile phones. This has a huge influence on online shopping. More than three-fourths of all online payments in China are done on mobile devices.

Interestingly, contrary to Western e-consumers who shop online mostly due to convenience, the Chinese see shopping as a form of social entertainment – and for this reason, they frequently show off their purchases on social media (1).

The most popular online shopping sites:

The cross-border e-commerce is one of the most important tendencies in the global e-commerce, and it cannot be overlooked. More and more entrepreneurs decide to take their sales beyond the borders of their countries and to explore the developing markets. This is where they can find new consumers, ready and willing to pay for exceptional products that they cannot find in the local e-stores.

In further articles we shall discuss the issue of international online payments and logistics solutions that the sellers can profit from. We shall also describe in more detail several markets which could be the most interesting for Polish entrepreneurs, so they could easier plan their foreign expansion.

1) Global Ecommerce Report 2018, Ecommerce Foundation, 2018

2) Cross-border e-commerce shopper survey, International Post Corporation, 2018

3) The truth about online consumers. Global Online Consumer Report, KPMG, 2017

4) Africa’s overlooked business revolution, McKinsey Quarterly, 2018