-

Our solutions

- Our solutions

-

About us

- About us

- Partners

- Support

- Offer

Romania, Bulgaria and Greece – the development opportunity for the Polish e-commerce.

The growing cross-border e-commerce trend brings immense opportunities for online stores. By extending sales outside the local market merchants can reach millions of new consumers, among whom the interest in online purchases from other countries is growing increasingly. You can read more about that trend in some of our previous articles:

We have also described in detail the Czech Republic, Slovakia and Hungary – three markets which, owing to their geographical proximity, could be a good direction for international expansion in Central Europe.

This article presents another three countries where the e-commerce shows a very high dynamics of growth. We invite you to take a tour of Romania, Bulgaria and Greece, where less than one-third of the residents shop online so far.

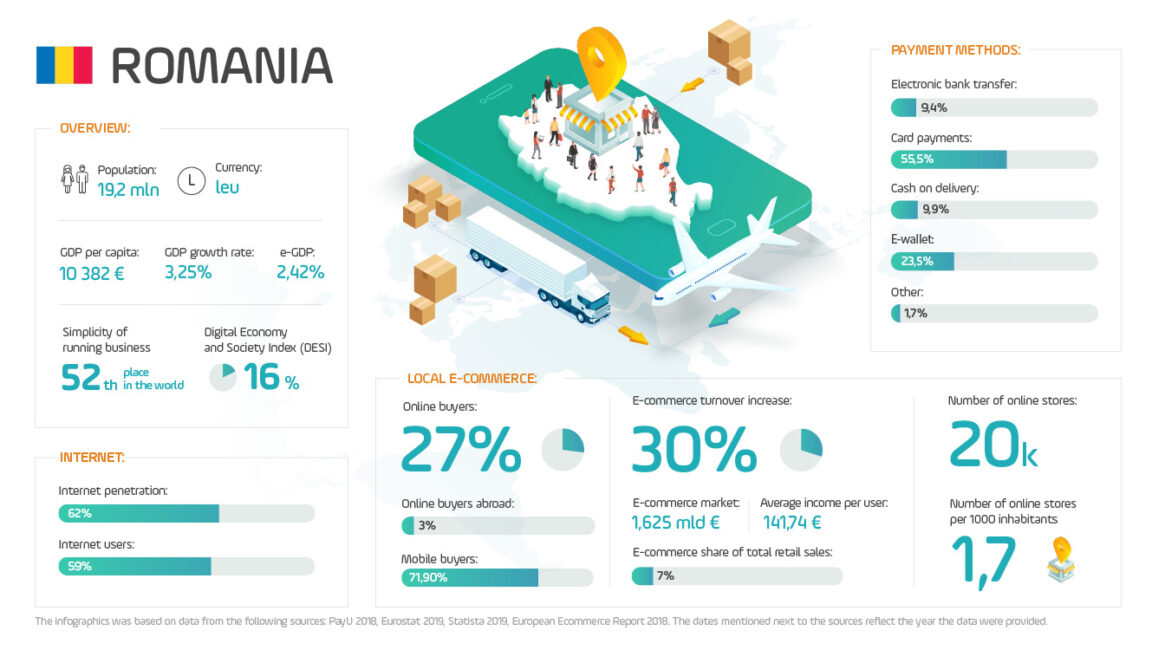

For the last few years, Romania has been among the European leaders, with the fastest growing and very promising economy. A significant increase of salaries, combined with reduction of VAT rates, resulted in huge increase of consumption among the citizens. [1] At the same time Romania has a high e-GDP per capita for a developing country (2.42%). The e-commerce, both local and cross-border, develops there at breathtaking speed.

Various local sources show that at the end of 2018 there have been around 35 000 websites with the .ro domain, with the “add to basket” option and a tab with payment options, owing to which they can be considered online stores. However, the low traffic registered at these sites means that they are not so important in the local e-commerce environment. At the same time not all sellers who opt for online sales via marketplaces have their own online stores, therefore the number of independent online stores in Romania is difficult to assess. [1]

The most popular online stores in Romania include: Emag.ro (which operates also as a marketplace), Altex.ro, Cel.ro, Elefant.ro, F64.ro, Evomag.ro, Flanco.ro. Auction platforms and marketplaces which are the most frequently selected by consumers include Emag.ro, Aliexpress and Amazon. The most popular search engine is the Romanian version of Google, and price comparison site – Compari.ro. [2]

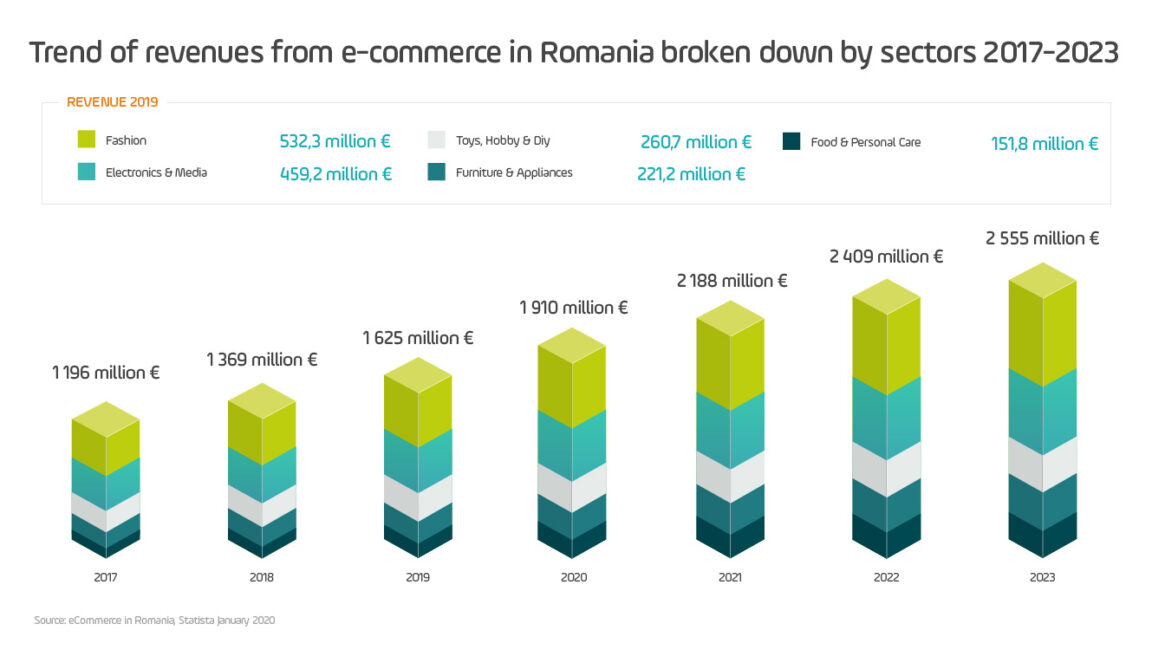

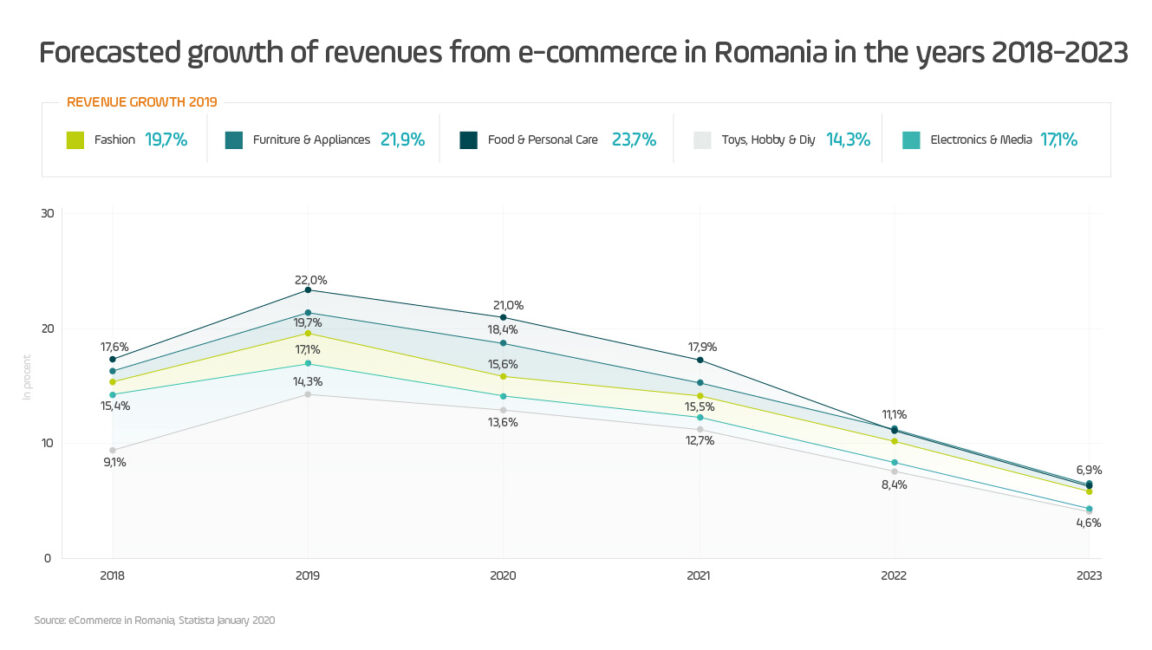

Fashion is the most popular shopping category in the Romanian e-commerce, generating annual revenue of more than EUR 532 million. [2] Other most popular categories of online purchases include electronic goods, toys and hobby-related goods. According to analyses by Statista, the coming years will see the strongest growth of the categories tied to food, personal hygiene, interior decoration and fashion. These categories will grow by several percent year on year.

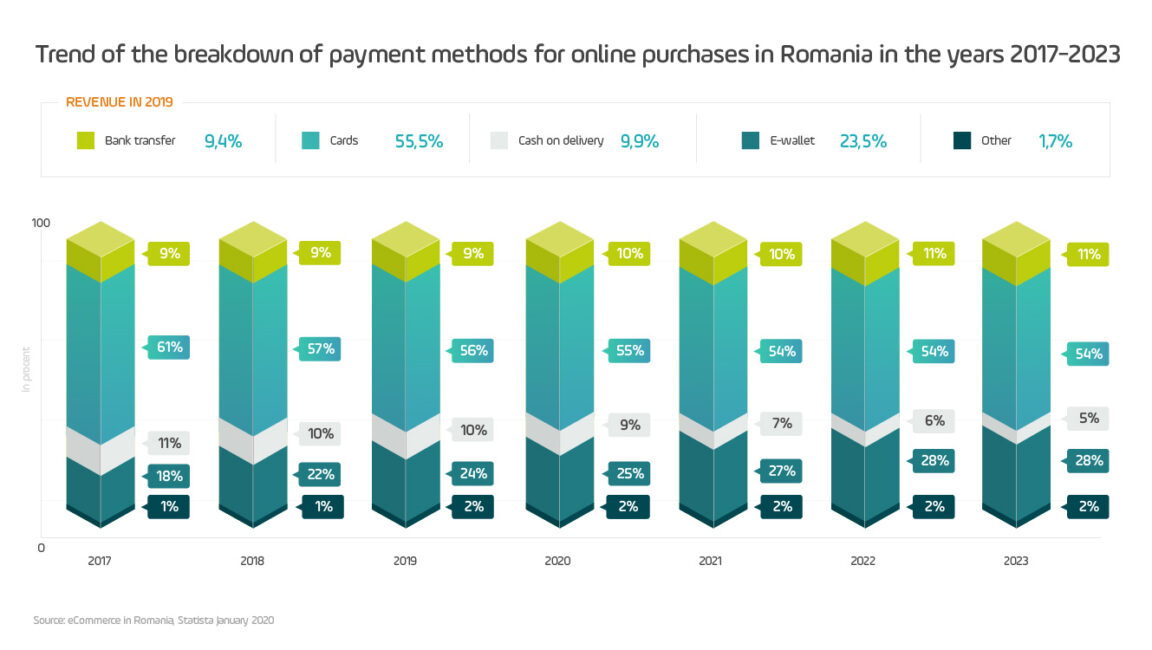

The most popular payment methods in Romania are credit cards: almost 56% of e-consumers opt for this type of payment for online shopping. The Romanians are increasingly interested in other, modern methods of online payments, which is reflected in the growing popularity of e-wallets – as much as 23.5% of all online transactions were paid for with the use of this method. Other preferred payment methods include cash on delivery (9.9%) and online bank transfer (9.4%). [2]

The interest of Romanians in cross-border shopping is growing slowly: in 2018 13% of e-consumers bought online products from sellers from European stores, and 3% from e-stores located elsewhere. Aliexpress and Amazon are the most popular foreign shopping websites chosen by the residents of Romania. [3]

The Romanians are barely discovering online shopping: only 23% of the country’s citizens have bought something online in 2019 [1] (in comparison to the 68% of Czechs or 53% of Hungarians who shop online). However, the strong increase of consumption and the relatively small competition in the e-commerce market (an average of 1.66 e-stores per 1K of residents) mean that expansion to this country offers a huge opportunity..

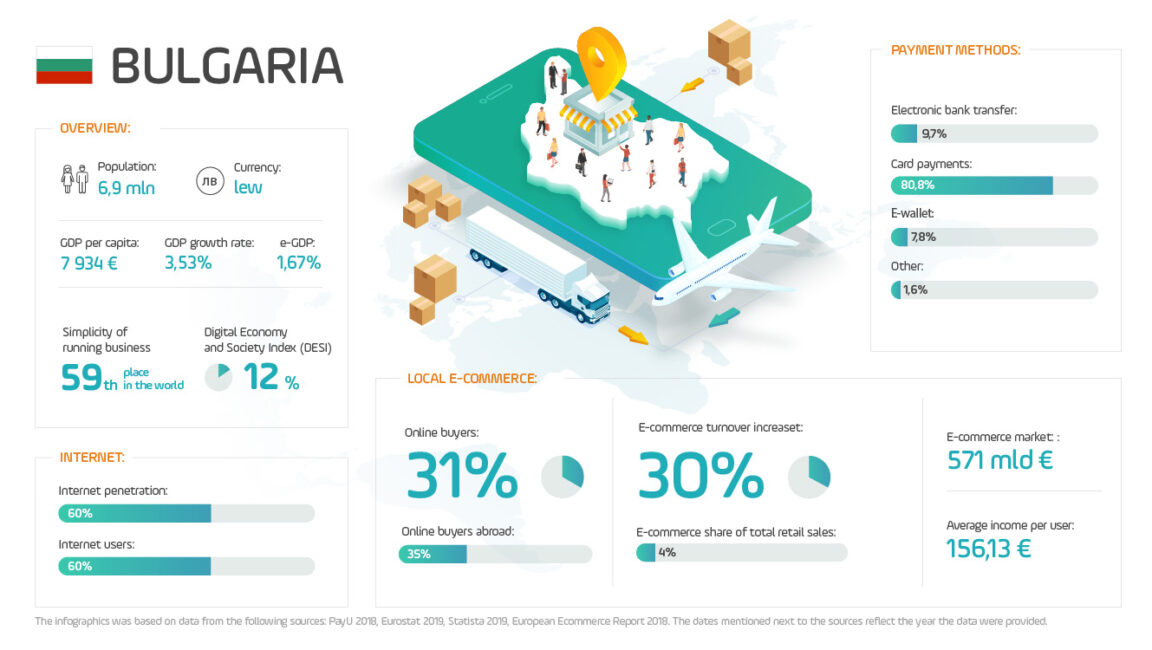

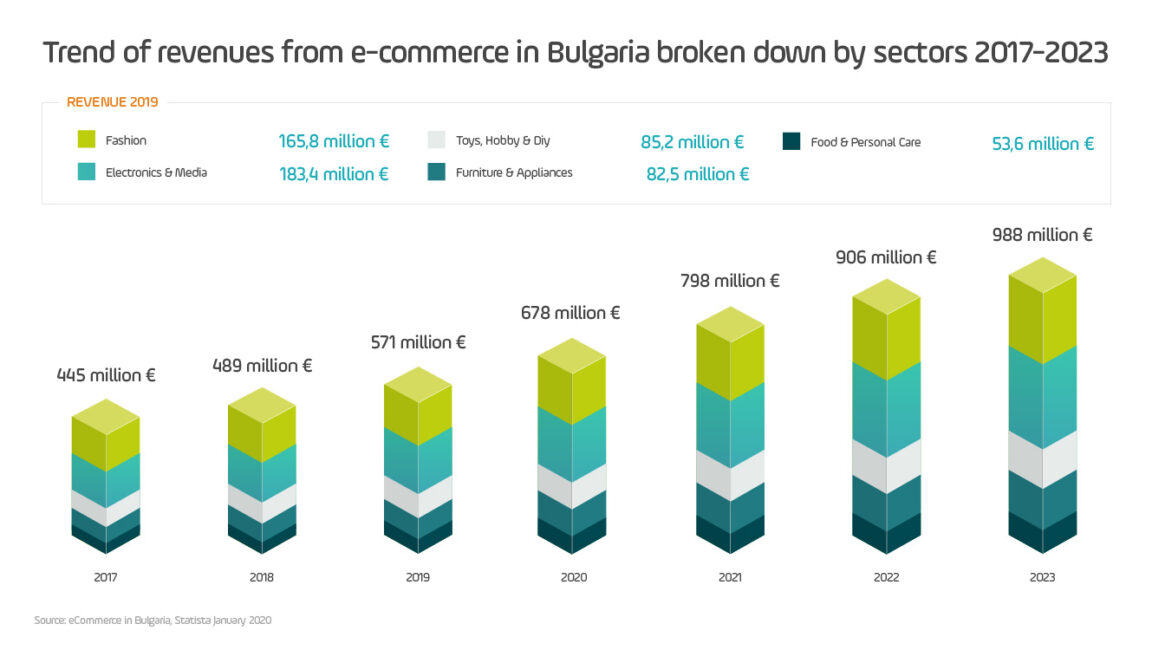

The Bulgarian e-commerce market, although still in its development phase, is growing and has a huge potential. Its annual growth rate is 11.3%. [5] More and more Bulgarians appreciate and value the convenience of online shopping: already as much as 31% of Bulgarians make their purchases online. [3] At the same time, the competition in the online sales market is not large: only 11% of Bulgarian companies decided to sell their products via the Internet, which offers a huge opportunity for e-stores from other countries. [6]

The most popular online stores among the Bulgarians include: Olx.bg, Bazar.bg, Pazaruvaj.com, Koketna.com, Bgfashionzone.com, Secretzone.bg and FashionDays.bg. The largest auction platforms and marketplaces popular among the locals include AliExpress.com, Emag.com and Amazon.com. The Bulgarians search for information using the local version of Google – Google.bg. Bulgaria has also group buying sites and their aggregators, such as Deals.bg or Grabo.bg. [7]

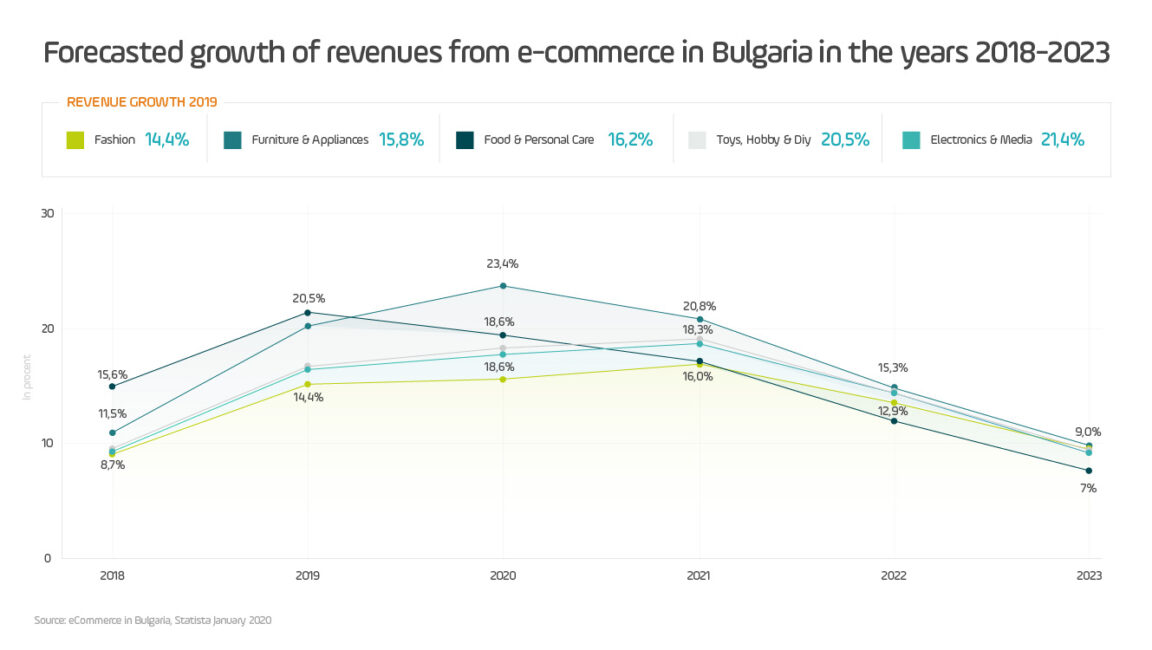

The Bulgarian e-commerce is dominated by two principal sectors: electronic goods and fashion, generating annual revenues of EUR 183.4 million and EUR 165.8 million. [5] The largest growth potential for the coming years, according to Statista analyzes, is shown by such categories of products as interior decoration, food, personal hygiene, as well as toys and hobby-related goods.

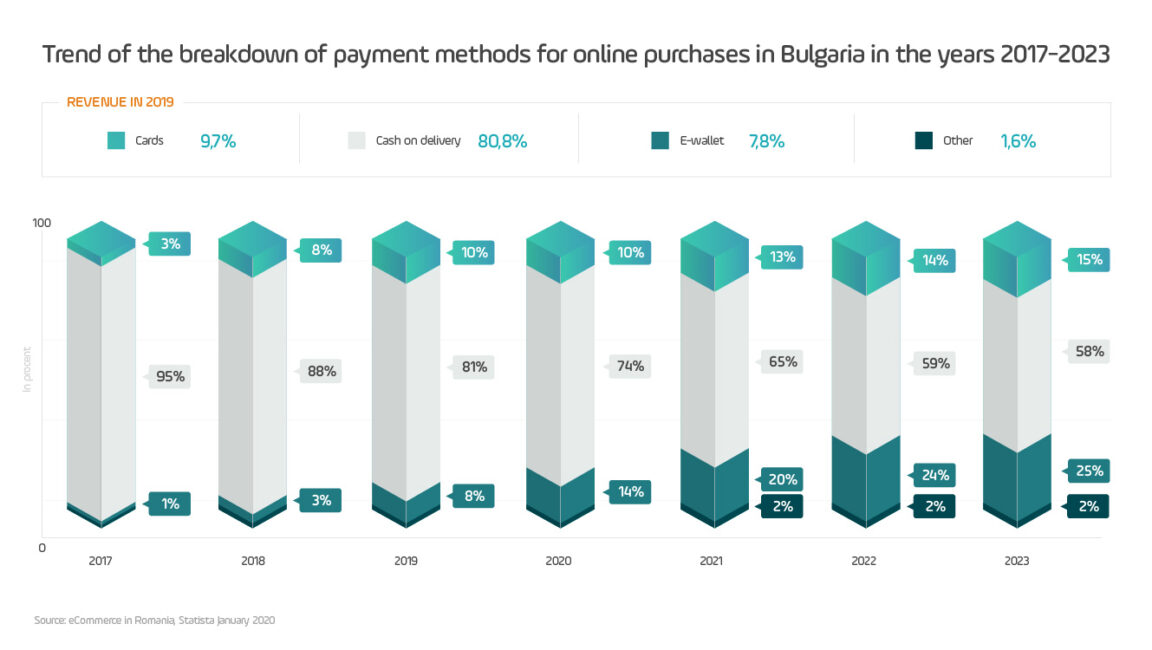

The dominant payment method for purchases in online stores is cash on delivery: in 2019 it was used to pay for as much as 81% of transactions. Online card payments and digital wallets are gaining popularity, however. It is predicted that by 2023 their total share in e-commerce payments would exceed 40%. [5]

Cross-border shopping becomes increasingly popular in Bulgaria – as much as 35% of consumers have already opted for online purchases from e-stores located in Europe, and 17% from e-stores in other countries of the world. [3] Bulgarians are most interested in using foreign sites of such e-commerce giants as Aliexpress or Amazon. [3]

Although Bulgaria is a relatively poorly developed market, it shows huge development potential. The annual growth rate at 11.3% (2018 vs. 2019), low level of competition in the local market (only 11% of Bulgarian companies sell their products via the Internet), or the relatively high openness of Bulgarians towards shopping in other countries mean that this market can be attractive for e-stores looking for ways to boost their sales.

The principal challenges associated with e-commerce, indicated by the Bulgarian consumers, include wrong functioning of websites at the stage of placing orders or making payment, waiting time for delivery longer than stated at the website, difficulties with finding warranty information or the delivery of wrong or damaged goods. [8] These factors may influence the Bulgarians’ shopping decisions, therefore it worth to take note of them when planning expansion to this market.

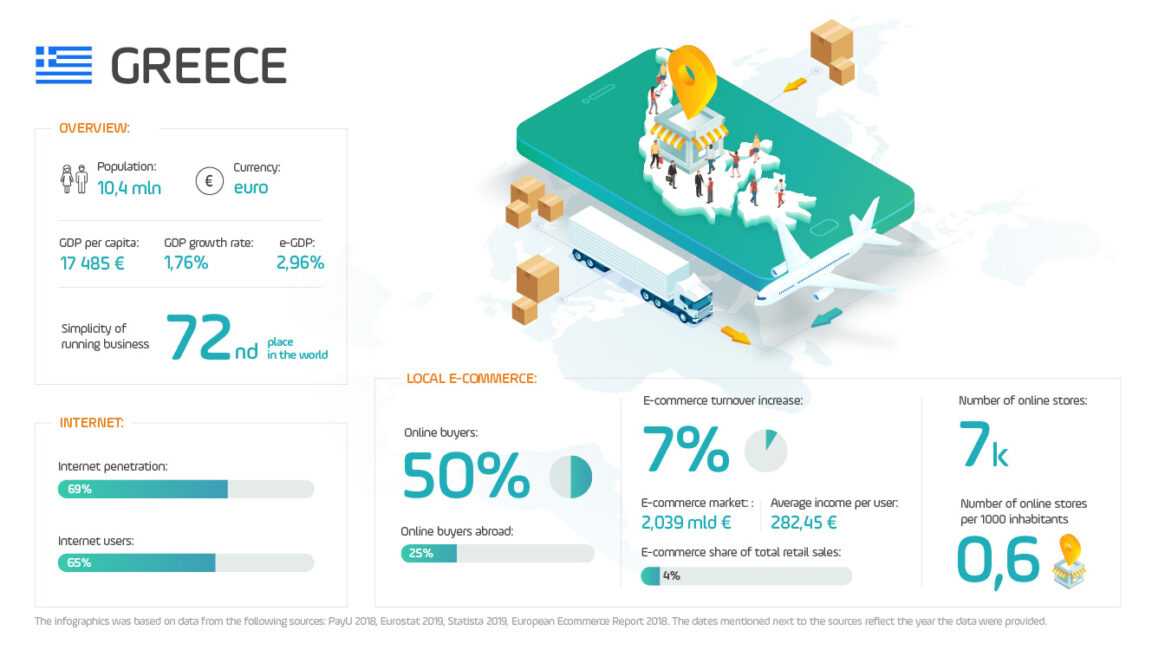

The Greek e-commerce market has been seeing year-on-year sales increases. The reason for this positive state of things is associated with the establishment of numerous, high-quality local e-stores in all product categories, and with the Greeks becoming sensitive to product prices. [9]

The Greeks have become highly dependent upon low prices when their income dropped drastically. At that time they realized that online shopping offers powerful benefits, such as the ability to compare prices of many products from various stores in a short time, or the attractive offers and discounts, usually unavailable in offline (physical) stores. [9]

Greece has about 7 thousands of e-stores. [9] This is still not much for almost 11 million of citizens: there is 0.63 of e-store per 1000 of inhabitants. The most popular stores among Greek consumers include Skroutz.gr, Xe.gr, Bestprice.gr and Public.gr. The largest auction sites and marketplaces popular among the locals include ebay.com, e-shop.gr and AliExpress.com. Google.gr is the most popular search engine. The Greeks are keen to use price comparison services, the most popular one is Bestprice.gr. [3]

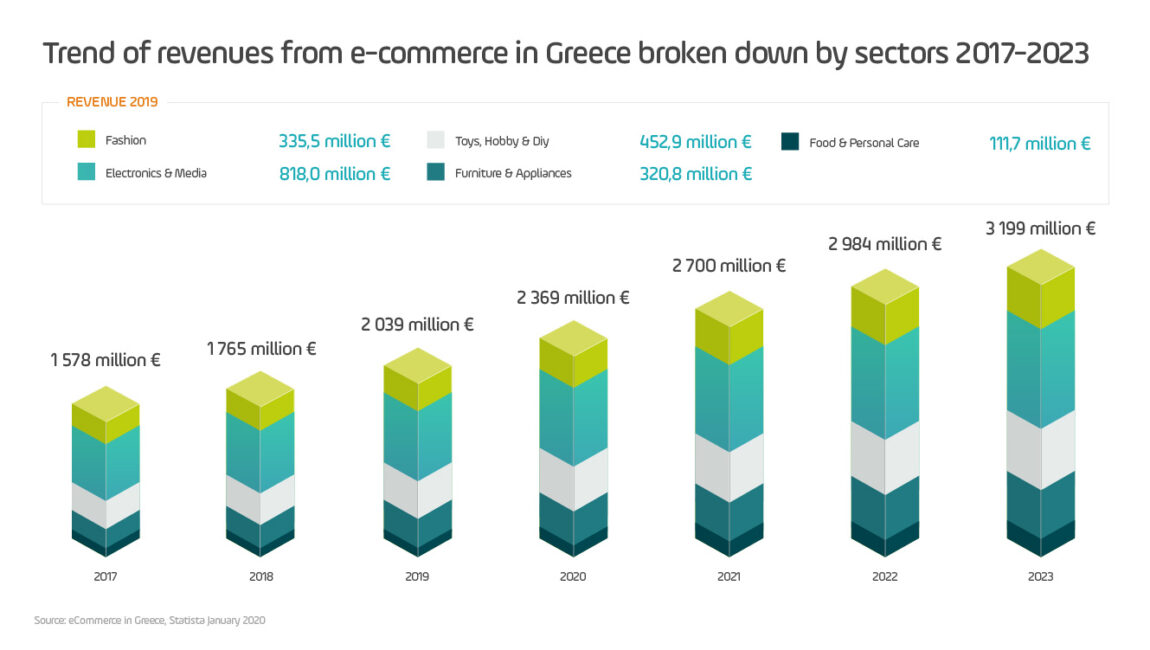

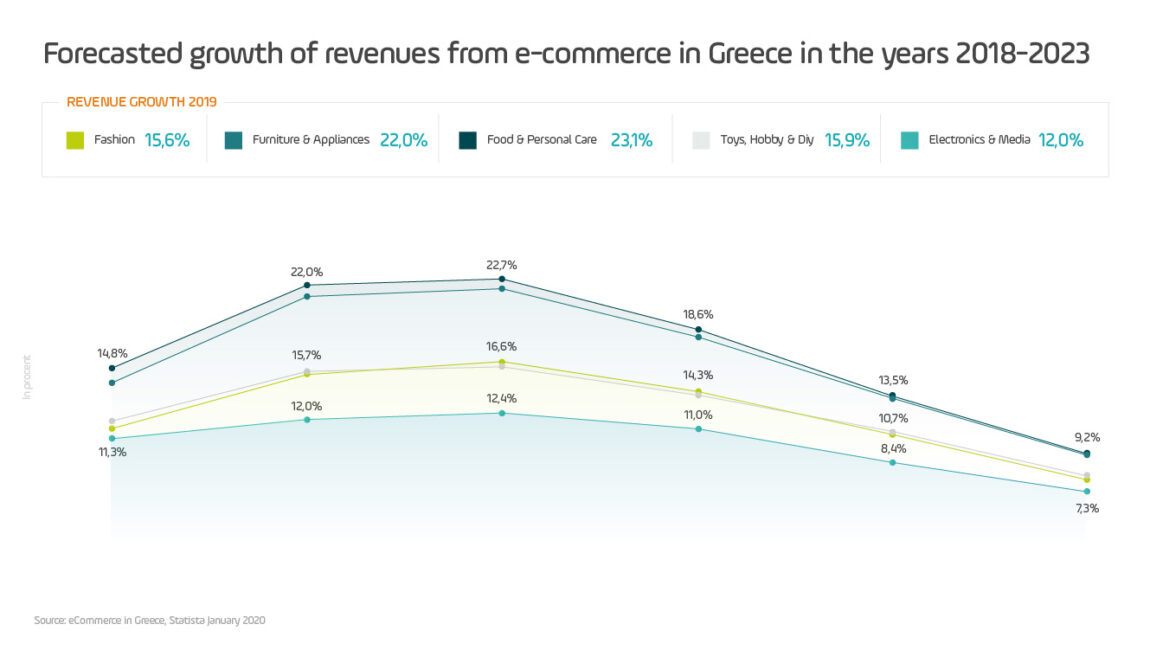

Electronic goods, toys, hobby-related goods and fashion are the shopping categories the most popular among Greek e-consumers. Revenues of the electronics sector, generated through e-commerce, reached EUR 818 million in 2019. [10] In terms of popularity, value of sectors and their growth levels, the most promising categories in terms of investment include: food, personal hygiene, interior decoration, fashion.

The most popular payment method in Greece is cash on delivery: it accounts for 54% of all online payments. The Greek e-consumers are increasingly willing to use credit card payments or digital wallets, however. That is why it is very important to offer customers the payment methods they prefer. Those customers who do not find their preferred, trusted payment methods in the online store frequently resign from the purchase and simply abandon their shopping basket.

Greeks are increasingly willing to profit from the unlimited opportunities offered by the Internet and decide to buy products at foreign stores: 35% of Greek e-consumers bought online products from sellers from European stores, and 19% from e-stores located elsewhere. [3] The most frequently selected sellers are located in the USA, Great Britain, China and Germany, [9] therefore it should come as no surprise that such services as eBay and Aliexpress are very popular among the Greeks. [3]

Greece is a strongly developing market which went through a grave crisis, but managed to pick itself up. This makes it an interesting and promising direction for expansion. The Greek e-consumers are increasingly willing to buy online, and are not afraid to shop in foreign stores. It is necessary to keep in mind that, although the average annual spend for online purchases will grow significantly in the coming years, the Greeks remain sensitive to product prices and its worth taking that in mind when planning entry into this market.

Greece is showing signs of revival after the economic crisis, but the past instability, well remembered by the residents, strongly affects consumer tendencies. For this reason, the hunt for deals will continue to be the most important factor fueling online sales in Greece, and sensitivity to prices – the main factor determining the purchase decision (75%). [9] Foreign online stores may consider the Greek market as a destination for international expansion if the products they offer are able to compete in terms of prices with the local offering.

Romania, Bulgaria and Greece are still developing e-commerce markets -they do not have a large number of online stores, and at the same time, they have a growing number of consumers willing to shop online. The e-consumers from these countries are increasingly looking for interesting alternatives to the offer of local e-stores, which in a natural manner incentivizes them to opt for cross-border online shopping. After analysis of specific purchase categories and consumers’ habits, it is worth thinking which of the discussed markets could be the best place to extend business beyond the already saturated Western European market.